Introduction

Koninklijke DSM N.V. (Royal DSM) is a company limited by shares listed on Euronext Amsterdam. It is managed by a Managing Board together with an Executive Committee and an independent Supervisory Board. Members of the Managing Board and the Supervisory Board are appointed (and, if necessary, dismissed) by the General Meeting of Shareholders.

The company is governed by Dutch law and by its Articles of Association, which can be consulted on the company website. The General Meeting of Shareholders decides on any amendment to the Articles of Association by an absolute majority of the votes cast. A decision to amend the Articles of Association may only be taken at the proposal of the Managing Board, subject to approval of the Supervisory Board.

At DSM, we fully inform our stakeholders about our corporate objectives, the way our company is managed, and our company's performance. In doing so, we aim to pursue an open dialogue with our shareholders and other stakeholders.

Our company has an organizational structure built around business groups that are empowered to perform all short-term and long-term business functions. In this they are assisted by support and corporate functions, as well as by regional organizations.

Managing Board and Executive Committee

The Executive Committee was installed to enable faster strategic alignment and operational execution by increasing our focus on the development of our business, innovation and people.

The Executive Committee comprises the Managing Board members as well as four senior managers with responsibility respectively for DSM Nutritional Products (Chris Goppelsroeder), DSM Food Specialties and Corporate Strategy & Acquisitions (Philip Eykerman), the DSM Innovation Center (Rob van Leen), and Group People & Organization (Judith Wiese). The latter four managers are appointed by the Chairman of the Managing Board after consultation with the Supervisory Board. The Executive Committee focuses on topics such as our company's overall strategy and direction, review of business results, functional and regional strategies, budget-setting, and people and organization. The statutory responsibilities of the Managing Board remain unchanged.

The Managing Board is ultimately responsible for our company's strategy, its portfolio management, the deployment of human capital and financial capital resources, the company's risk management system, its financial performance, and its performance in the area of sustainability. The Managing Board is thus also accountable to the Supervisory Board for our company's strategy and management. The full Managing Board attends the Supervisory Board meetings. Other Executive Committee members attend those Supervisory Board meetings, or parts of them, that are specifically relevant to their area of responsibility.

The Managing Board consists of two or more members, to be determined by the Supervisory Board. The current composition of the Managing Board can be found in the chapter Supervisory Board and Managing Board Royal DSM. Since the introduction of the Dutch Corporate Governance Code in 2004, members of the Managing Board have been appointed for a period of four years.

The members of the Managing Board are collectively responsible for the management of DSM. In addition to this collective responsibility, Managing Board members have individual responsibility for certain tasks, business clusters, functional areas, and regions. The distribution of these tasks is published on the company website.

The remuneration of Managing Board members is determined by the Supervisory Board based on the remuneration policy approved by the General Meeting of Shareholders. The remuneration policy for the Managing Board can be found in the 'Report by the Supervisory Board' under Remuneration policy Managing Board.

The functioning of and decision-making within the Managing Board and the Executive Committee are governed by the Regulations of the Managing Board, which are in accordance with the Dutch Corporate Governance Code and can be found on the company website.

In 2018, the Managing Board and Executive Committee had 39 formal meetings, some of these by teleconference. No Managing Board member had to be excused from meetings during the year. In five Executive Committee meetings, a member was excused on account of other commitments. In all cases, members who were unable to attend gave advance input for the meeting either in writing or via other members. The Executive Committee and Managing Board take the time for an evaluation at the end of every meeting they have. This evaluation can be about topics that have been discussed that meeting, but also reflecting on meeting dynamics and individual or collective performance. Furthermore, there are several informal moments, such as a collective dinner at the end of a full-day meeting, built into the meeting schedule. Once a year, the Executive Committee and Managing Board take the time to get together and discuss their performance as a team.

Supervisory Board

The Supervisory Board comprises at least five members. Its current composition can be found in the chapter Supervisory Board and Managing Board Royal DSM. Supervisory Board members are appointed for a period of four years, after which they may be reappointed for a further four years. A Supervisory Board member may subsequently be reappointed for a period of two years, and this appointment may be extended by at most two years. For reappointment after an eight-year period, reasons must be provided in the report of the Supervisory Board.

All current members of the Supervisory Board are independent in accordance with the Dutch Corporate Governance Code. The remuneration of Supervisory Board members is determined by the General Meeting of Shareholders. The functioning of and decision making within the Supervisory Board are governed by the Regulations of the Supervisory Board, which are in accordance with the Dutch Corporate Governance Code and can be found on the company website.

The Supervisory Board supervises the policy pursued by the Managing Board, the Managing Board's performance of its managerial duties, and the company's general course of affairs, taking the interests of all the company's stakeholders into account. When the Executive Committee was established, the Supervisory Board also took on responsibility for ensuring that the checks and balances that are part of the two-tier system are still taken into account, paying specific attention to the dynamics between Managing Board and Executive Committee. The Supervisory Board is enabled to do so through the information provided to it by the Managing Board.

The annual financial statements are approved by the Supervisory Board and then submitted to the Annual General Meeting of Shareholders (AGM) for adoption, accompanied by an explanation by the Supervisory Board of how it carried out its supervisory duties during the year under review.

In line with the Dutch Corporate Governance Code, the Supervisory Board has established from among its members an Audit Committee, a Nomination Committee and a Remuneration Committee, besides which there is also a Sustainability Committee.

The task of these committees is to prepare the decision-making of the Supervisory Board. These committees are governed by charters drawn up in line with the Dutch Corporate Governance Code. They can be found on the company website.

Diversity

At DSM, we strongly value diversity, and we endeavor to reflect this in our Board memberships. The Supervisory Board has drafted diversity policies for the Supervisory Board, the Managing Board and the Executive Committee. These policies seek a balanced composition of the respective body, taking into account gender, age, knowledge, experience, and nationality / cultural background. In addition, for the composition of the Supervisory Board, the board tenure is taken into account.

In terms of gender diversity, we aim for at least 30% of the positions in our Supervisory Board, Managing Board and Executive Committee to be held by women and at least 30% by men — percentages which reflect Dutch legislation. To ensure a balanced composition in terms of nationality/cultural background, our aim is not to have more than 50% of the members of our Supervisory Board or Executive Committee drawn from a single nationality. While a diverse composition in terms of nationality/cultural background is also taken into account in the composition of the Managing Board, no quantitative target is set here, given the relatively small number of Managing Board members.

Our diversity policies are implemented by applying them to nominations for (re)appointments of Supervisory Board and Managing Board members as well as to appointments of Executive Committee members. At the 2018 Annual General Meeting, Rob Routs was reappointed based on his extensive experience and knowledge and his qualities as Chair of our Supervisory Board, as demonstrated during his eight-year tenure to date. The at the time on-going regular strategic review and the fact that the Deputy Chair was stepping down at the 2018 AGM were additional reasons to safeguard continuity in the Supervisory Board.

Geraldine Matchett was reappointed as a member of the Managing Board following her significant contribution to the execution of our company strategy and the improvements — including financial improvements — made during her first tenure as member of the Managing Board. This reappointment also reflects the leadership qualities she has shown through her contributions to the Managing Board and the Executive Committee. With her reappointment, the diversity in terms of gender, nationality, experience and knowledge within the Managing Board and Executive Committee was continued.

Both our Supervisory Board and our Managing Board were well balanced in 2018 in terms of gender, comprising 43% and 33% women respectively, which is in line with Dutch legislation and with the company's own diversity policy. The gender diversity level of 29% women within our Executive Committee comes very close to our target for at least 30% of these positions to be held by women and at least 30% by men. With the appointment of Patricia Malarkey as Chief Innovation Officer, our Executive Committee's gender diversity will be 43% in 2019. The composition of both our Supervisory Board and our Executive Committee are in line with our target of not having more than 50% of the members drawn from a single nationality. Furthermore, in the Supervisory Board of DSM Nederland B.V., a subsidiary of Royal DSM, one of the three members is female (33%).

General Meeting of Shareholders

The main powers of the General Meeting of Shareholders relate to:

- The appointment, suspension and dismissal of members of the Managing Board and the Supervisory Board

- Approval of the remuneration policy of the Managing Board

- Approval of the remuneration of the Supervisory Board

- The adoption of the annual financial statements and declaration of dividends on ordinary shares

- Release from liability of the members of the Managing Board and the Supervisory Board

- Issuance of shares or rights to shares, restriction or exclusion of pre-emptive rights of shareholders and repurchase or cancellation of shares

- Amendments to the Articles of Association

- Decisions of the Managing Board that would entail a significant change in the identity or character of DSM or its business

The Annual General Meeting (AGM) is held within six months of the end of the financial year in order to discuss and, if applicable, adopt the Annual Report, the annual accounts, any appointments of members of the Managing Board and the Supervisory Board, and any of the other topics mentioned above.

The AGM and, if necessary, other General Meetings of Shareholders are called by the Managing Board or the Supervisory Board. The agenda and explanatory notes are published on the company website.

According to the Articles of Association, shareholders who, individually or jointly, represent at least 1% of the issued capital have the right to request the Managing Board or the Supervisory Board to put items on the agenda. Such requests need to be received in writing by the Chairman of the Managing Board or the Chair of the Supervisory Board at least 60 days before the date of the General Meeting of Shareholders.

The AGM was held on 9 May 2018. The agenda was essentially similar to that of previous years. Additional topics were the implementation of the new Dutch Corporate Governance Code, the reappointment of Rob Routs as a member of the Supervisory Board and the reappointment of Geraldine Matchett as a member of the Managing Board.

The Articles of Association were amended to reflect changes in law and regulations including the implementation of the new Dutch Corporate Governance Code published on 8 December 2016 and applicable as of the financial year 2017. Further details can be found on the company website.

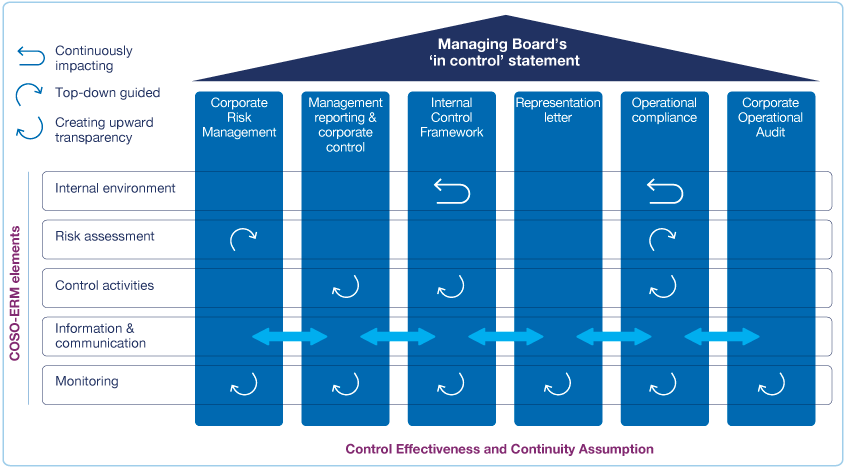

Control effectiveness and continuity assumption

The Statements of the Managing Board are reported in the Statements of the Managing Board. These conform with the Dutch Corporate Governance Code best practice 1.4.3 on 'Board Statements'.

At DSM, we visualize our control environment as a 'house' that includes the internal control process areas with control measures related to strategic, operational, compliance and reporting risks. The elements of COSO (the Committee of Sponsoring Organizations of the Treadway Commission) provide a framework for identifying company activities that are carried out to ensure that the control environment is adequately structured. Finally, to make sure that a learning curve is achieved, monitoring activities include the sharing of findings and experiences as well as the application of control measures across the supporting pillars.

DSM's structure for managing risks involves three lines of defense (see also Risk management). Line management within the units is responsible for the first line of defense. Risk management forms the second line of defense, assessing the effectiveness of risk management and internal control at both unit and corporate level. Corporate Operational Audit (COA) is the third line of defense. The scope and frequency of COA audits is determined by ranking the auditable units according to the scale of their risk exposure, using a set of defined characteristics.

COA assesses the operation of risk management activities by the units, as well as the design of the risk management and internal control systems, by performing risk-based audits. These examine the key processes and activities for the specific units. By means of these audits, COA closes the risk management cycle and provides additional assurance to the Managing Board as to the effectiveness of the design and operation of the risk management and internal control systems.

COA reports its audit results to the Managing Board twice a year. COA also shares an overview with the Audit Committee of the Supervisory Board and communicates the executive summary of each audit report to the CFO and CEO.

In 2018, COA carried out 47 audits. In general, audit findings are considered opportunities for improvement as part of a healthy learning culture. In approximately 11% of the audited areas (e.g. operations, finance, SHE, commercial) significant management attention was required to achieve the DSM standard. In the rare event of insufficient follow-up on a finding, the Director of COA escalates that finding to the CEO.