Corporate governance

Introduction

Koninklijke DSM N.V. (Royal DSM) is a company limited by shares listed on Euronext Amsterdam. It is managed by a Managing Board together with an Executive Committee and an independent Supervisory Board. Members of the Managing Board and the Supervisory Board are appointed (and, if necessary, dismissed) by the General Meeting of Shareholders.

The company is governed by Dutch law and by its Articles of Association, which can be consulted on the company website. The General Meeting of Shareholders decides on any amendment to the Articles of Association by an absolute majority of the votes cast. A decision to amend the Articles of Association may only be taken at the proposal of the Managing Board, subject to approval of the Supervisory Board.

At DSM, we fully inform our stakeholders about our corporate objectives, the way our company is managed, and our company's performance. In doing so, we aim to pursue an open dialogue with our shareholders and other stakeholders.

Our company has an organizational structure built around business groups that are empowered to perform all short-term and long-term business functions. In this they are assisted by support and corporate functions, as well as by regional organizations.

Managing Board and Executive Committee

The Executive Committee was installed to enable faster strategic alignment and operational execution by increasing our focus on the development of our business, innovation and people.

The Executive Committee comprises the Managing Board members as well as four senior managers with responsibility respectively for DSM Nutritional Products (Chris Goppelsroeder), DSM Food Specialties and Corporate Strategy & Acquisitions (Philip Eykerman), the DSM Innovation Center (Rob van Leen), and Group People & Organization (Judith Wiese). The latter four managers are appointed by the Chairman of the Managing Board after consultation with the Supervisory Board. The Executive Committee focuses on topics such as our company's overall strategy and direction, review of business results, functional and regional strategies, budget-setting, and people and organization. The statutory responsibilities of the Managing Board remain unchanged.

The Managing Board is ultimately responsible for our company's strategy, its portfolio management, the deployment of human capital and financial capital resources, the company's risk management system, its financial performance, and its performance in the area of sustainability. The Managing Board is thus also accountable to the Supervisory Board for our company's strategy and management. The full Managing Board attends the Supervisory Board meetings. Other Executive Committee members attend those Supervisory Board meetings, or parts of them, that are specifically relevant to their area of responsibility.

The Managing Board consists of two or more members, to be determined by the Supervisory Board. The current composition of the Managing Board can be found in the chapter Supervisory Board and Managing Board Royal DSM. Since the introduction of the Dutch Corporate Governance Code in 2004, members of the Managing Board have been appointed for a period of four years.

The members of the Managing Board are collectively responsible for the management of DSM. In addition to this collective responsibility, Managing Board members have individual responsibility for certain tasks, business clusters, functional areas, and regions. The distribution of these tasks is published on the company website.

The remuneration of Managing Board members is determined by the Supervisory Board based on the remuneration policy approved by the General Meeting of Shareholders. The remuneration policy for the Managing Board can be found in the 'Report by the Supervisory Board' under Remuneration policy Managing Board.

The functioning of and decision-making within the Managing Board and the Executive Committee are governed by the Regulations of the Managing Board, which are in accordance with the Dutch Corporate Governance Code and can be found on the company website.

In 2018, the Managing Board and Executive Committee had 39 formal meetings, some of these by teleconference. No Managing Board member had to be excused from meetings during the year. In five Executive Committee meetings, a member was excused on account of other commitments. In all cases, members who were unable to attend gave advance input for the meeting either in writing or via other members. The Executive Committee and Managing Board take the time for an evaluation at the end of every meeting they have. This evaluation can be about topics that have been discussed that meeting, but also reflecting on meeting dynamics and individual or collective performance. Furthermore, there are several informal moments, such as a collective dinner at the end of a full-day meeting, built into the meeting schedule. Once a year, the Executive Committee and Managing Board take the time to get together and discuss their performance as a team.

Supervisory Board

The Supervisory Board comprises at least five members. Its current composition can be found in the chapter Supervisory Board and Managing Board Royal DSM. Supervisory Board members are appointed for a period of four years, after which they may be reappointed for a further four years. A Supervisory Board member may subsequently be reappointed for a period of two years, and this appointment may be extended by at most two years. For reappointment after an eight-year period, reasons must be provided in the report of the Supervisory Board.

All current members of the Supervisory Board are independent in accordance with the Dutch Corporate Governance Code. The remuneration of Supervisory Board members is determined by the General Meeting of Shareholders. The functioning of and decision making within the Supervisory Board are governed by the Regulations of the Supervisory Board, which are in accordance with the Dutch Corporate Governance Code and can be found on the company website.

The Supervisory Board supervises the policy pursued by the Managing Board, the Managing Board's performance of its managerial duties, and the company's general course of affairs, taking the interests of all the company's stakeholders into account. When the Executive Committee was established, the Supervisory Board also took on responsibility for ensuring that the checks and balances that are part of the two-tier system are still taken into account, paying specific attention to the dynamics between Managing Board and Executive Committee. The Supervisory Board is enabled to do so through the information provided to it by the Managing Board.

The annual financial statements are approved by the Supervisory Board and then submitted to the Annual General Meeting of Shareholders (AGM) for adoption, accompanied by an explanation by the Supervisory Board of how it carried out its supervisory duties during the year under review.

In line with the Dutch Corporate Governance Code, the Supervisory Board has established from among its members an Audit Committee, a Nomination Committee and a Remuneration Committee, besides which there is also a Sustainability Committee.

The task of these committees is to prepare the decision-making of the Supervisory Board. These committees are governed by charters drawn up in line with the Dutch Corporate Governance Code. They can be found on the company website.

Diversity

At DSM, we strongly value diversity, and we endeavor to reflect this in our Board memberships. The Supervisory Board has drafted diversity policies for the Supervisory Board, the Managing Board and the Executive Committee. These policies seek a balanced composition of the respective body, taking into account gender, age, knowledge, experience, and nationality / cultural background. In addition, for the composition of the Supervisory Board, the board tenure is taken into account.

In terms of gender diversity, we aim for at least 30% of the positions in our Supervisory Board, Managing Board and Executive Committee to be held by women and at least 30% by men — percentages which reflect Dutch legislation. To ensure a balanced composition in terms of nationality/cultural background, our aim is not to have more than 50% of the members of our Supervisory Board or Executive Committee drawn from a single nationality. While a diverse composition in terms of nationality/cultural background is also taken into account in the composition of the Managing Board, no quantitative target is set here, given the relatively small number of Managing Board members.

Our diversity policies are implemented by applying them to nominations for (re)appointments of Supervisory Board and Managing Board members as well as to appointments of Executive Committee members. At the 2018 Annual General Meeting, Rob Routs was reappointed based on his extensive experience and knowledge and his qualities as Chair of our Supervisory Board, as demonstrated during his eight-year tenure to date. The at the time on-going regular strategic review and the fact that the Deputy Chair was stepping down at the 2018 AGM were additional reasons to safeguard continuity in the Supervisory Board.

Geraldine Matchett was reappointed as a member of the Managing Board following her significant contribution to the execution of our company strategy and the improvements — including financial improvements — made during her first tenure as member of the Managing Board. This reappointment also reflects the leadership qualities she has shown through her contributions to the Managing Board and the Executive Committee. With her reappointment, the diversity in terms of gender, nationality, experience and knowledge within the Managing Board and Executive Committee was continued.

Both our Supervisory Board and our Managing Board were well balanced in 2018 in terms of gender, comprising 43% and 33% women respectively, which is in line with Dutch legislation and with the company's own diversity policy. The gender diversity level of 29% women within our Executive Committee comes very close to our target for at least 30% of these positions to be held by women and at least 30% by men. With the appointment of Patricia Malarkey as Chief Innovation Officer, our Executive Committee's gender diversity will be 43% in 2019. The composition of both our Supervisory Board and our Executive Committee are in line with our target of not having more than 50% of the members drawn from a single nationality. Furthermore, in the Supervisory Board of DSM Nederland B.V., a subsidiary of Royal DSM, one of the three members is female (33%).

General Meeting of Shareholders

The main powers of the General Meeting of Shareholders relate to:

- The appointment, suspension and dismissal of members of the Managing Board and the Supervisory Board

- Approval of the remuneration policy of the Managing Board

- Approval of the remuneration of the Supervisory Board

- The adoption of the annual financial statements and declaration of dividends on ordinary shares

- Release from liability of the members of the Managing Board and the Supervisory Board

- Issuance of shares or rights to shares, restriction or exclusion of pre-emptive rights of shareholders and repurchase or cancellation of shares

- Amendments to the Articles of Association

- Decisions of the Managing Board that would entail a significant change in the identity or character of DSM or its business

The Annual General Meeting (AGM) is held within six months of the end of the financial year in order to discuss and, if applicable, adopt the Annual Report, the annual accounts, any appointments of members of the Managing Board and the Supervisory Board, and any of the other topics mentioned above.

The AGM and, if necessary, other General Meetings of Shareholders are called by the Managing Board or the Supervisory Board. The agenda and explanatory notes are published on the company website.

According to the Articles of Association, shareholders who, individually or jointly, represent at least 1% of the issued capital have the right to request the Managing Board or the Supervisory Board to put items on the agenda. Such requests need to be received in writing by the Chairman of the Managing Board or the Chair of the Supervisory Board at least 60 days before the date of the General Meeting of Shareholders.

The AGM was held on 9 May 2018. The agenda was essentially similar to that of previous years. Additional topics were the implementation of the new Dutch Corporate Governance Code, the reappointment of Rob Routs as a member of the Supervisory Board and the reappointment of Geraldine Matchett as a member of the Managing Board.

The Articles of Association were amended to reflect changes in law and regulations including the implementation of the new Dutch Corporate Governance Code published on 8 December 2016 and applicable as of the financial year 2017. Further details can be found on the company website.

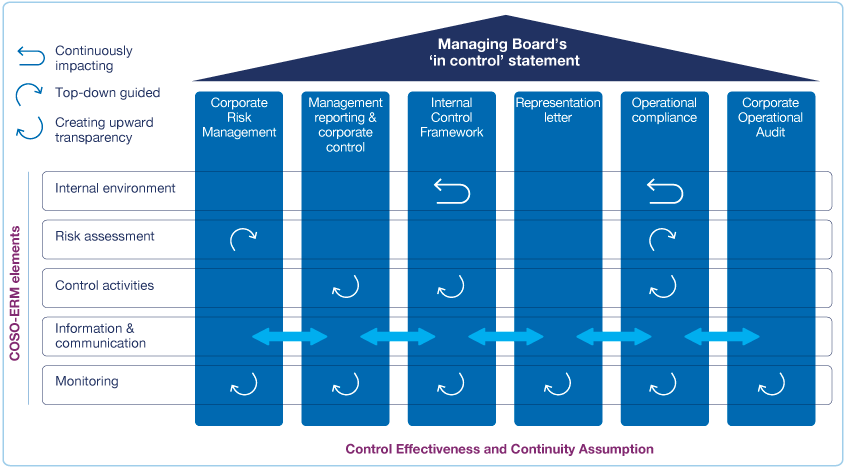

Control effectiveness and continuity assumption

The Statements of the Managing Board are reported in the Statements of the Managing Board. These conform with the Dutch Corporate Governance Code best practice 1.4.3 on 'Board Statements'.

At DSM, we visualize our control environment as a 'house' that includes the internal control process areas with control measures related to strategic, operational, compliance and reporting risks. The elements of COSO (the Committee of Sponsoring Organizations of the Treadway Commission) provide a framework for identifying company activities that are carried out to ensure that the control environment is adequately structured. Finally, to make sure that a learning curve is achieved, monitoring activities include the sharing of findings and experiences as well as the application of control measures across the supporting pillars.

DSM's structure for managing risks involves three lines of defense (see also Risk management). Line management within the units is responsible for the first line of defense. Risk management forms the second line of defense, assessing the effectiveness of risk management and internal control at both unit and corporate level. Corporate Operational Audit (COA) is the third line of defense. The scope and frequency of COA audits is determined by ranking the auditable units according to the scale of their risk exposure, using a set of defined characteristics.

COA assesses the operation of risk management activities by the units, as well as the design of the risk management and internal control systems, by performing risk-based audits. These examine the key processes and activities for the specific units. By means of these audits, COA closes the risk management cycle and provides additional assurance to the Managing Board as to the effectiveness of the design and operation of the risk management and internal control systems.

COA reports its audit results to the Managing Board twice a year. COA also shares an overview with the Audit Committee of the Supervisory Board and communicates the executive summary of each audit report to the CFO and CEO.

In 2018, COA carried out 47 audits. In general, audit findings are considered opportunities for improvement as part of a healthy learning culture. In approximately 11% of the audited areas (e.g. operations, finance, SHE, commercial) significant management attention was required to achieve the DSM standard. In the rare event of insufficient follow-up on a finding, the Director of COA escalates that finding to the CEO.

Dutch Corporate Governance Code

DSM supports the Dutch Corporate Governance Code, which was most recently amended in 2016 and has been in force since the financial year 2017. The Dutch Corporate Governance Code can be found on www.mccg.nl.

We ensure our continued compliance with the Dutch Corporate Governance Code. The proposal to amend the Articles of Association — to reflect changes in law and regulations, including the implementation of the new Dutch Corporate Governance Code — was approved by the Annual General Meeting of Shareholders on 9 May 2018.

Long-term value creation is embedded in both our company Strategy 2021: Growth & Value - Purpose led, Performance driven and our company culture: Our purpose is to create brighter lives for all. Sustainability is central to how we fulfill that mission, and to achieve this, we consider People, Planet and Profit in all we do. We apply our company strategy to drive our business and innovation strategies, which address the challenges of Nutrition & Health, Climate & Energy, and Resources & Circularity. More information on how long-term value creation is fundamental to our strategy and culture can be found in the Strategy and People sections of this Report, as well as in How we create value for our stakeholders and in DSM and the Sustainable Development Goals.

Regarding the appointment of members of the Managing Board for a period of at most four years (Principle 2.2 of the Dutch Corporate Governance Code), it should be noted that we have adhered to this principle since the introduction of the Dutch Corporate Governance Code in 2004. Since we respect agreements made before the introduction of the said code, the current Chairman of the Managing Board will remain appointed for an indefinite period.

Any proposed substantial change to our corporate governance structure and compliance with the Dutch Corporate Governance Code should be submitted to the General Meeting of Shareholders for discussion under a separate agenda item.

All documents related to the implementation of the Dutch Corporate Governance Code at DSM can be found in the 'Corporate Governance' section of the company website.

Governance framework

Organizational & operating model

Our business groups are the main building-blocks of the company's organization. They have integral long-term and short-term responsibility for business and have at their disposal all functions that are crucial to their business success. As the company's primary organizational and entrepreneurial building-blocks, our business groups focus on four primary business functions: Innovation and R&D, Direct Sourcing, Manufacturing & Operations, and Marketing & Sales. Intra-company product supplies are contracted by the business groups on an arm's-length basis.

The business groups are organized into clusters, thus ensuring coherence of operations and the leveraging of resources within each cluster. The clusters are the main organizational entities for external strategic and financial reporting. This structure ensures flexibility, efficiency and speed of response to market changes. In order to ensure sufficient independence regarding financial management, the CFO has no business groups reporting to her.

Our business groups receive services from global support functions and functional excellence departments and are supported by the regional organizations. This set-up enables us to create a global, high-performing organization focused on meeting its targets and achieving its ambitions. The support functions and functional excellence departments are paid for their services by the users — the business groups and, to a lesser extent, other DSM units. Corporate departments are paid from a corporate budget.

Support functions provide those services that can be delivered more efficiently (in terms of total cost of ownership) by leveraging them across the company, thus capturing scale benefits and delivering higher quality at lower cost, rather than having them arranged in each business group separately.

Within support functions, centers of expertise provide specialist support, while shared service centers provide standard transactional support. Business partnering is the concept that acts as the interface between the business groups and the support functions. Business partners consequently have a second reporting line in the business. In order to ensure that the functional policies sufficiently reflect regional requirements, the support functions work closely with the regional organizations and integrate their advice.

Each support function reports to a Managing Board member. There are support functions in the areas of Finance, People & Organization, Legal, Indirect Sourcing, Communications and ICT.

Corporate functions (small, high-level groups) supporting the Managing Board and Executive Committee are also seen as support functions. The corporate departments are: Corporate Strategy & Acquisitions, Corporate Operational Audit, Group Risk Management, Corporate Sustainability, Corporate Investor Relations and Corporate Affairs.

Functional excellence departments are mandated by the Managing Board to help the businesses achieve excellence in their respective fields. They cover the areas of Operations & Responsible Care, Marketing & Sales and Science & Technology. Functional excellence departments support our businesses in improving their performance. They also provide guidance in setting aspiration levels and targets.

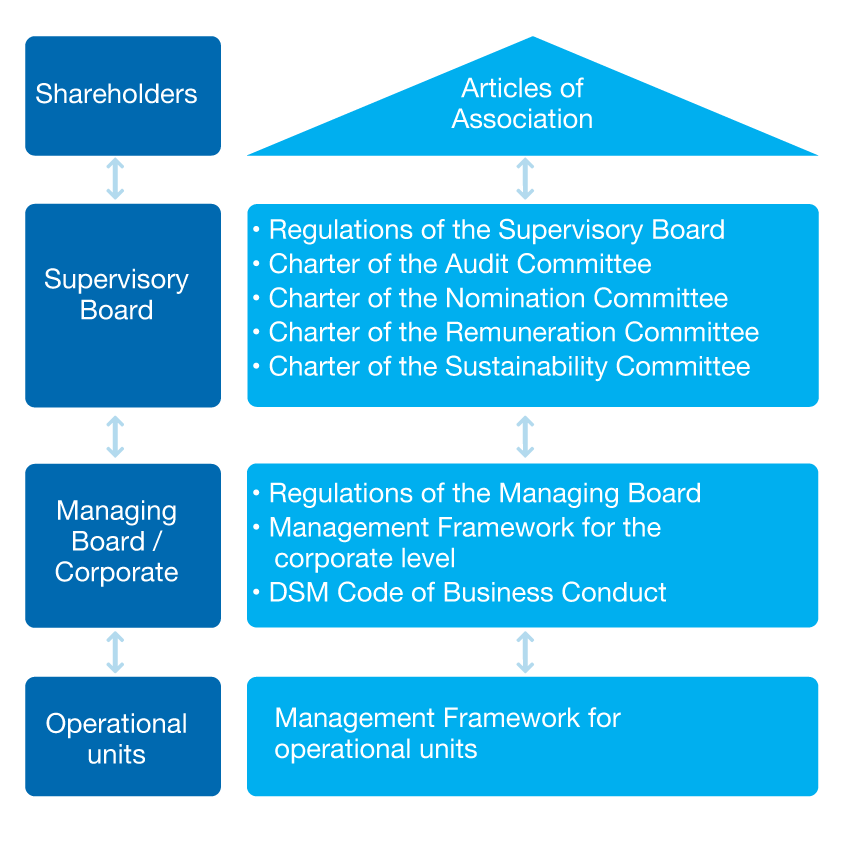

Governance framework

The following figure depicts our company's overall governance framework and the most important governance elements and regulations at each level.

For the sake of clarity, a short summary of the main aspects of the framework at Managing Board/corporate level and operational level is given here. The Managing Board and Executive Committee adhere to the Regulations of the Managing Board. The Managing Board and Executive Committee work according to the Management Framework for the corporate level. This implies, among other things, that they adhere to the DSM Code of Business Conduct and applicable corporate policies and requirements. The Management Framework for the corporate level further provides a description of the most important (decision-making) processes, responsibilities and 'rules of the game' at Managing Board, Executive Committee, functional and regional levels, and includes governance relations with the immediately superior levels (Supervisory Board and shareholders) and the operational units.

The company's strategic direction and objectives are set by means of a Corporate Strategy Dialogue. In June 2018, DSM presented its updated Strategy 2021: Growth & Value - Purpose led, Performance driven, which is described in more detail, see Strategy 2021.

The operational units conduct their business within the parameters of the Management Framework for operational units. This implies, among other things, that they:

- Comply with the DSM Code of Business Conduct, Corporate Requirements and Directives

- Establish the strategy, objectives and operational targets of their business according to the Business Strategy Dialogue, in alignment with the Corporate Strategy Dialogue, in which various scenarios and related risk profiles are investigated, and report on the achievement of these

- Implement risk management actions according to an Annual Risk Management Plan and in line with corporate policies

- Execute company-wide standards for support functions (systems, processes, vendors, etc.)

- Implement annual functional improvement plans, monitor the effectiveness of the risk management and internal control system by means of process risk assessments and internal audits, and regularly discuss the findings with the Executive Committee member responsible

Independent audits for all operational units are conducted by the Corporate Operational Audit (COA) department. The Director of COA reports to the CFO and has access to the Chairman of the Managing Board, the external auditor and the Audit Committee of the Supervisory Board. Furthermore, the Director of COA acts as the compliance officer regarding inside information and is also the secretary of the Disclosure Committee, as well as being chair of the DSM Alert Committee, which is responsible for our whistleblower policy, systems and processes.

Chaired by the CFO, the Disclosure Committee ensures the timely and accurate disclosure of share-price-sensitive information related to the company and is responsible for the implementation of company rules on the holding and execution of transactions in the company's financial instruments, among other things.

A third committee at corporate level is the Fraud Committee, which was installed to ensure structural follow-up of fraud cases with the aim of reducing fraud exposure. Relevant corporate functions participate in the Fraud Committee, which is chaired by the CFO.

Sustainability Governance Framework

Managing Board

Sustainability falls under the responsibility of the Managing Board. While CEO/Chairman of the Managing Board Feike Sijbesma is the primary point of contact, other members also chair sustainability topics and initiatives.

Feike Sijbesma oversaw sustainability as a key responsibility and company value as well as a driver of business growth. He also oversaw our engagement with organizations including the United Nations and the World Bank, our strategic partnership with the World Economic Forum and our nutrition-related initiatives including the WFP partnership.

Geraldine Matchett integrated sustainability into financial decision making and represented DSM in the Accounting for Sustainability (A4S) CFO Leadership Network. She also oversaw our efforts and commitment toward the Taskforce for Climate-related Financial Disclosures recommendations, and chaired the Inclusion & Diversity Council.

Dimitri de Vreeze was responsible for Safety, Health and Environment (SHE) and also oversaw our Supplier Sustainability Program and the sourcing of electricity from renewable sources in his responsibility for the Sourcing function.

Supervisory Board

Our Supervisory Board has its own Sustainability Committee to oversee progress against targets and to report on the embedding of sustainability across the organization. For more details, see Supervisory Board Report.

External Sustainability Advisory Board

Comprising a diverse international group of thought leaders, DSM's Sustainability Advisory Board acts as a sparring partner for the Managing Board and senior executives, to help sharpen their focus on strategic issues, deepen their understanding of external stakeholder needs, conduct advocacy and handle dilemmas. This board met twice in 2018 together with the Managing Board and a number of senior executives. Subjects included DSM's corporate strategy update and purpose, innovation project and business updates, science-based targets, digitization and the future of transport. They also took the opportunity to visit DSM-Niaga, DSM Dyneema and DSM Advanced Solar locations. In Amsterdam, they hosted employees in a townhall session to exchange thoughts on DSM and sustainability. Jessica Fanzo stepped down from the board due to the requirements of her new position at the Food and Agriculture Organization of the United Nations. Ertharin Cousin, the former Executive Director of the United Nations World Food Programme, joined the board, and in doing so, maintained the desired balance of knowledge across our three focus domains. This board also benefits greatly from its gender and nationality diversity.

Sustainability Advisory Board

|

Member

|

Background

|

|

Robin Chase (f)

|

Co-founder and former CEO of Zipcar, co-founder of Veniam, board member of the World Resources Institute, and Tucows, and serves as an informal advisor to many cities, national governments, and transport agencies on the transition to shared automated vehicles. Nationality: American.

|

|

Ertharin Cousin (f)

|

Distinguished Fellow with The Chicago Council on Global Affairs and Trustee on the UK based Power of Nutrition Board of Directors. She served as the twelfth Executive Director of the United Nations World Food Programme from 2012 to 2017. Nationality: American.

|

|

Paul Gilding (m)

|

Social entrepreneur, author and corporate strategy advisor. Fellow at the University of Cambridge Institute for Sustainability Leadership (UK). In 2011, he published his book 'The Great Disruption'. In the 1990s, he was executive director of Greenpeace International. Nationality: Australian.

|

|

David King (m)

|

Senior Strategic Adviser to the President of Rwanda since May 2018. Partner at SYSTEMIQ since 2017. Special representative for climate change of the UK government from 2013 to 2017. From 2008 to 2012, he served as the founding director of the Smith School of Enterprise and the Environment at the University of Oxford (UK). Chief Scientific Advisor to the UK government 2000–2007. Nationality: British.

|

|

Ndidi Nwuneli (f)

|

Social entrepreneur and Founder of LEAP Africa and co-founder of AACE Food Processing & Distribution Ltd. (AACE Foods), an indigenous agro-processing company in Nigeria. She is also the managing partner of Sahel Consulting Agriculture & Nutrition, which works across West Africa, unlocking the potential of the nutrition and agriculture landscapes. Nationality: Nigerian.

|

|

Ye Qi (m)

|

Cheung Kong Professor of Environmental Policy, Volkswagen Professor of Sustainability, and director of Brooking-Tsinghua Center for Public Policy at Tsinghua University in Beijing (China). Before he joined Tsinghua, he taught at Beijing Normal University, and the University of California at Berkeley (California, USA). Nationality: American.

|

Global network

At a corporate level, sustainability is steered by our Sustainability Leadership Team, a group of senior executives representing the business groups and contributing corporate functions, which is chaired by the Vice President Sustainability. He leads the Corporate Sustainability department and reports directly to CEO Feike Sijbesma. The Corporate Sustainability staff function as a business-oriented center of excellence and partner on sustainability, internally and externally.

The Sustainability Leadership Team meets quarterly to monitor the progress of sustainability across the company, with particular emphasis on steering our business and innovation portfolio following key drivers. Regional operational sustainability networks are in place in China, India, Latin America and North America.

DSM Operations & Responsible Care has responsibility for all corporate issues related to SHE. The Senior Vice President DSM Operations & Responsible Care reports directly to the Managing Board. SHE managers provide support at business group level. Our SHE Council, which includes all business group SHE managers, is instrumental in sharing experiences and developing best practices and communications on SHE issues.

Our CFO, Geraldine Matchett, has appointed a finance executive to lead a taskforce addressing the recommendations of the Taskforce on Climate-related Financial Disclosures (TCFD). The taskforce, comprising representatives from finance, risk management, sustainability, and investor relations, works with functions such as strategy, operations and procurement, to define what is needed to meet our commitments toward TCFD. It convened several times in 2018 to discuss how we will integrate long-term climate thinking into the Risk Management and Finance processes.