Nutrition

|

x € million

|

2018

|

2017

|

|

|

Total

|

Underlying business1

|

||

|

Net sales:

|

|||

|

DSM Nutritional Products:

|

|||

|

- Animal Nutrition & Health

|

3,134

|

2,749

|

2,660

|

|

- Human Nutrition & Health

|

2,019

|

1,989

|

1,939

|

|

- Personal Care & Aroma Ingredients

|

382

|

382

|

353

|

|

- Other2

|

112

|

112

|

86

|

|

5,647

|

5,232

|

5,038

|

|

|

DSM Food Specialties

|

490

|

490

|

541

|

|

Total

|

6,137

|

5,722

|

5,579

|

|

Organic sales growth (in %)

|

14

|

7

|

8

|

|

Adjusted EBITDA

|

1,407

|

1,117

|

1,053

|

|

Adjusted operating profit

|

1,111

|

821

|

770

|

|

Capital expenditure

|

463

|

463

|

407

|

|

Capital employed at 31 December

|

5,683

|

5,683

|

5,420

|

|

ROCE (in %)

|

19.9

|

14.7

|

14.1

|

|

Adjusted EBITDA margin (in %)

|

22.9

|

19.5

|

18.9

|

|

R&D expenditure

|

206

|

206

|

219

|

|

Workforce at 31 December (headcount)

|

13,628

|

13,628

|

13,676

|

1 Excluding temporary vitamin effect, see Key business figures at a glance

2 Other covers pharma and custom manufacturing & services activities

Business

Our Nutrition cluster comprises DSM Nutritional Products and DSM Food Specialties. This cluster provides solutions for animal feed, food and beverages, pharmaceuticals, early life nutrition, nutrition improvement, dietary supplements and personal care. Our company is positioned in all steps of the feed and food value chains: the production of pure active ingredients, their incorporation into sophisticated forms and the provision of tailored premixes and forward solutions. Our unique portfolio of products and services is global and highly diversified, serving customers and other stakeholders locally across various end-markets around the world.

Nutrition cluster performance

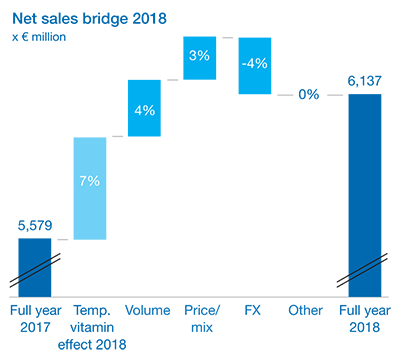

In Nutrition, we benefited from a temporary vitamin effect caused by an exceptional supply disruption in the industry. Adjusted for the total estimated temporary vitamin effect of €415 million (mainly in Animal Nutrition & Health), our underlying organic growth was up 7% compared to 2017, with €5,722 million sales. Volumes were up 4% from the previous year and above-market growth. The price growth of 3% was partly offset by a negative foreign currency impact. Conditions were good across most regions and market segments in 2018. The Adjusted EBITDA from underlying business was up 6% from 2017, to €1,117 million. The Adjusted EBITDA margin from underlying business was 19.5%, versus 18.9% over 2017.

Total Nutrition sales increased by 10%, to €6,137 million (compared to €5,579 million in 2017), including a total estimated €415 million temporary vitamin effect. The total Adjusted EBITDA was up 34% to €1,407 million, benefiting from a total estimated €290 million temporary vitamin effect.

Over the strategic period, Nutrition continued to deliver on its aspired above-market growth ambition and further leveraged our unique global products & local solutions business model, supported by marketing and sales excellence and customer-led innovation.

Trends

The world is facing an increasing number of food-related health issues and challenges. According to the UN Food and Agriculture Organization (FAO), more than 800 million people go hungry to bed each night. The International Food Policy Research Institute (IFPRI) estimates that approximately two billion, meanwhile, suffer from hidden hunger — meaning that their diet lacks sufficient micronutrients such as vitamins and dietary minerals. IFPRI additionally puts the number of adults and children who are obese or overweight at more than 2.3 billion.

With our nutritional solutions, we are well positioned to actively combat malnutrition in all its forms: undernutrition, hidden hunger, overweight, obesity and the double burden of malnutrition (the coexistence of undernutrition with overweight and obesity), as well as diet-related non-communicable diseases. We have established numerous partnerships in this field, including those with WFP, UNICEF, Vitamin Angels and World Vision. We are also addressing malnutrition through the humanitarian organization Sight and Life and our dedicated Nutrition Improvement business segment — specialized in supplementation programs and fortification of staple foods and therapeutic or emergency foods with essential vitamins and minerals in developing countries.

We are also addressing antimicrobial resistance (AMR) through our broad portfolio of nutritional products, including our eubiotics.

Finally, with our nutritional solutions, we play an important role in helping to repair the world's food systems. This is essential, as we are witnessing the transgression of several planetary boundaries in the agri-food sector.

Whereas earlier generations struggled primarily with the threat of communicable diseases such as tuberculosis, cholera and plague, non-communicable diseases (NCDs) are now the number one cause of death worldwide, accounting for 70% of all mortalities. These include cardiovascular disease, type 2 diabetes and cancer. Research increasingly identifies unhealthy and/or unbalanced diets as a major contributor to many NCDs. Intermediate indicators that can be related to an increased risk of NCDs are elevated levels of markers such as increased blood pressure, Body Mass Index (BMI) and high blood glucose. Balanced nutrition plays a role in keeping these indicators at healthy levels, hence helping to reduce the risks of NCDs. Besides solutions to reduce sugar and salt in processed foods, we also produce OatWell®, a nutritional ingredient that harnesses the scientifically-proven health benefits of oat beta-glucan to reduce cholesterol levels.

WHO predicts that antimicrobial resistance (AMR) is expected to overtake NCDs by 2050 as the world's leading cause of death. WHO defines AMR as the ability of a micro-organism (such as bacteria, viruses, and some parasites) to stop an antimicrobial (such as antibiotics, antivirals and antimalarials) from working against it. AMR is on the increase due to the over-prescription of antibiotics, the continued use of antibiotics in some livestock farming operations, and the release of antibiotics into the environment from pharmaceutical factories. At DSM, we address the topic of AMR and the responsible use of antibiotics in livestock production through our broad portfolio of nutritional products, such as our eubiotics for gastrointestinal functionality.

Environmental scientists warn that we are on the verge of going beyond the limits of several planetary boundaries if we do not change our food system, risking people's livelihoods and the ability to produce the food for all. These concern greenhouse gas (GHG) emissions, biochemical flows, water quality and quantity, land use, and biodiversity. The agri-food sector is one of the major contributors to global GHG emissions, and almost a third of wild fisheries are overexploited. We work with customers and other stakeholders to deliver more sustainable solutions that have less impact on the environment, especially in Animal Nutrition & Health. For example, our enzymes help animals improve digestion and extract more nutritional value from feed. That way, they still grow well even when they eat less. As a result, fewer natural resources, such as land and water, are needed for animal protein production.

Consumers are becoming increasingly selective about where their food comes from and how it is produced. There is a growing worldwide trend in favor of natural and plant-based foods, including viable alternatives to animal-sourced foods (meat, fish and dairy). Running counter to this trend, there is also a simultaneous growth in global demand for animal-sourced foods, with clear regional differentiation. We aim to help consumers choose in favor of sustainably produced and healthy nutrition by providing tasty, enjoyable food and supporting initiatives. We also enable and produce sustainable proteins, both animal- and plant-based.

Sustainability & Innovation

Sustainability is one of the key drivers of our Nutrition cluster. Our nutrition businesses support many of the UN Sustainable Development Goals (SDGs), especially SDGs 2, 3, 12 and 13.

We are proud of our strategic partnership with the UN World Food Programme (WFP), which we extended for another three years. We have partnered with WFP since 2007 to develop cost-effective, sustainable and nutritious food solutions for those in need. In 2017, over 39.4 million people benefited from improved nutrition through WFP. Thanks to our expertise in nutrition and food fortification, WFP has improved its food basket and developed more nutritious food products for disadvantaged people around the world. These products include Super Cereal and Super Cereal Plus (complementary foods), ready-to-use supplementary foods, high-energy biscuits, micronutrient powders such as MixMe™, and fortified rice. We also provide funding for WFP's operations and motivate employees to engage in fundraising campaigns and awareness-raising initiatives for WFP's school meal programs. Finally, we combine our strengths to put local networks in place that ensure sustainable and increased access to more nutritious food as an essential part of healthy diets. Together, we are helping people survive and thrive.

In addition to our work on hunger, malnutrition, health and well-being, our innovations are increasingly focused on improved sustainability throughout the product lifecycle and the value this can bring to customers and society at large.

For example, in 2018 we introduced Balancius™, a broiler feed ingredient that helps to facilitate digestion and the absorption of nutrients from the diet. We also made significant progress in Veramaris®, our joint venture with Evonik to produce the omega-3 fatty acids EPA and DHA from natural marine algae as an alternative to fish-oil-based omega-3. In 2018, we also continued our work on Project Clean Cow to develop a feed solution that helps reduce methane emissions from cows by at least 30%. Methane is a potent greenhouse gas that makes a significant contribution to climate change. Ruminants such as cows are responsible for approximately 27% of anthropogenic methane emissions globally (see Animal Nutrition & Health).

After a successful initial market introduction in North America in mid-2018, we accelerated our large innovation project for fermentative Stevia by establishing a joint venture with Cargill, as announced last November. Stevia is a zero-calorie, cost-effective sweetener that can substitute sugar in food and beverages. In personalized nutrition, we announced a strategic partnership with digital health company Mixfit and became their largest shareholder. This collaboration unites our expertise in micronutrients with Mixfit's proprietary technology, creating the ability to analyze health data in real time (see Human Nutrition & Health).

Governments around the world are focusing increasingly on the environmental footprint of their domestic industries. In recent years, China in particular has tightened the enforcement of its environmental regulations, also known as its 'Blue Skies' policy. This policy addresses air, soil and water pollution and sets significantly higher standards than before, including those standards applicable to China's many small and medium-sized vitamin manufacturers. The result is a more level playing field for non-Chinese competitors versus these manufacturers.

We have been a very reliable player in this market, able to support customers through this period of uncertainty while at the same time being a frontrunner in compliance. In 2018, we invested €50 million to upgrade our vitamin C facilities in Jiangshan (Jiangsu Province, China), improving environmental performance and enhancing worker safety. This commitment goes beyond simply meeting legislative requirements to set new sustainability standards, allowing brands that use our products to make eco-friendly positioning claims. We are also in the process of introducing a natural gas-fired plant, following a strategic agreement on steam and electricity supply as part of the province's aim of reducing the number of coal-fired power plants to meet 2020 targets.

Strategy

Our Nutrition cluster has unparalleled access to customers thanks to our global network and our ability to customize formulations for local markets, especially through our premix solutions. This cluster is active in more than 60 countries. Our strategy accelerates growth by focusing on four key areas:

- Expanding our core

- Adding new products and solutions

- Expanding in new segments and regions

- New business models

We have been expanding our core by adding new premix facilities to our global network. Two new facilities for Animal Nutrition & Health were opened in Peru and India in 2018, while in Human Nutrition & Health we started the development in Poland of the world's only premix site serving the maternal and infant nutrition market exclusively.

In terms of adding new products and solutions, the launch of Balancius™ represents a major breakthrough in animal nutrition. Optimizing gastrointestinal functionality is crucial for efficient feed utilization, for example in poultry farming. Many other examples of new products and solutions can be found throughout this chapter.

Expanding into new segments and regions is also a key part of our Nutrition strategy. In 2017, we acquired BioCare (Denmark) and added probiotics to our gut health offering. We completed the integration of this business during 2018.

Our fourth growth area, new business models, mainly represents our drive to move further down the value chain, closer to consumers and farmers. A growing proportion of our Human Nutrition & Health revenue now comes from custom nutrient premixes, market-ready solutions and direct-to-consumer products that address diverse health or lifestyle benefits. For Animal Nutrition & Health we introduced an app through which Chinese farmers and suppliers can place orders, track inventories and monitor feed quantities, as well as being able to check pork prices.

Across our nutrition businesses, we continue to work on operational and commercial excellence. In 2018, we started a program in DSM Nutritional Products to create a more customer-centric and cross-functional organization. Our key cross-functional capabilities, such as customer care and supply chain, have been elevated and strengthened. We are moving toward becoming more collaborative through new ways of working. We have aligned customer-centric KPIs across the organization. All of these measures result in tangible business impact on key metrics, such as on-time in-full (OTIF), delivery, speedy complaint handling (CIRT) and inventory levels.

Furthermore, we fully implemented our new market-segment approach in Human Nutrition & Health (i.e. pharma, dietary supplements, food & beverage, early life nutrition, medical nutrition, nutrition improvement). In addition to the regional geographic focus, these global market segments have been designed to drive even greater customer intimacy and growth, while at the same time providing insights to key innovation needs for the future.

Within our Animal Nutrition & Health business we started a similar improvement program in 2018, called acCElerate, aimed at commercial excellence and amplifying the customer experience.

At the start of 2018, our DSM Food Specialties business adopted a customer-centric organizational structure, switching from a product-led to a market-focused model for our commercial operations.

In June 2018, we communicated our updated Strategy 2021. More detail on our Nutrition strategy can be found in the Strategy 2021 chapter.

We take a balanced view of our business, and therefore as we seize opportunities, we also manage risks. For more information on how we manage risks, see Risk management.

DSM Nutritional Products

In 2018, an exceptional supply disruption in the industry positively impacted our sales. We have estimated a temporary vitamin effect of €415 million additional sales, mainly in Animal Nutrition & Health. Excluding this temporary vitamin effect, in the so-called underlying business, we achieved organic growth of 7%, with strong volumes, up 4% as well as price growth of 3%, supported by good conditions across most regions and market segments. DSM Nutritional Products had total sales of €5,647 million in 2018, including the estimated temporary vitamin effect, a 12% increase compared to €5,038 million in 2017.

Animal Nutrition & Health

Highlights 2018

- Strong organic growth

- Launch of Balancius™, the world's first microbial muramidase

- Expansion of premix network with new facilities in Peru and India

- Integration of Dutch premixer Twilmij

- Creation of Veramaris® and construction of new production site in Blair (Nebraska, USA)

In 2018, the Animal Nutrition & Health business benefited from a total estimated temporary vitamin effect caused by exceptional supply disruptions in the industry. In the underlying business, organic growth was up 8% compared to the previous year. Volumes were up 4% and prices were also up 4% from the previous year. Business conditions were favorable in almost all regions. Sales to Brazil were softer due to temporary shutdowns mainly driven by strikes in the second quarter. Prices were supported by initiatives to mitigate higher input costs of sourced ingredients and the impact of negative foreign currencies, as well as by the effects of the 'Blue Skies' policy in China.

We continued to benefit from our strategy of addressing a wide range of species, as well as from our diversified global presence, with our unique portfolio and forward-integrated premix solutions.

Including the total estimated temporary vitamin effect, total sales were €3,134 million in 2018 compared to €2,660 million in 2017. This good growth was achieved against a tough comparative year.

Animal Nutrition & Health serves the global feed industry with innovative and sustainable nutritional solutions. A pioneer since the earliest days of feed additives, we draw on the latest science to provide a unique portfolio that runs from vitamins through carotenoids to cutting-edge eubiotics and feed enzymes. Population growth and rising incomes are driving demand for animal protein. Our products help producers of animal feed and meat, including farmers, to raise animals more efficiently and sustainably.

Our swine business showed solid growth in 2018. The impact of African swine flu was largely mitigated by growth in other segments. Poultry also performed quite well compared to 2017. Higher consumption, driven by attractive prices and the diversity of the end-products derived from poultry, was the main driver for the poultry industry's growth.

Our gut health strategy continued to stimulate sales of eubiotics for gastrointestinal functionality in 2018. Sales of these products enjoyed strong growth for the second consecutive year.

Our Crina® range of essential oils saw strong demand in key markets in 2018. Crina® Poultry Plus was complemented by the launch of Crina® Digest, a unique and cost-effective combination of three essential oil compounds with a novel controlled release technology. Crina® Poultry Plus is the market-leading solution, combining a unique and complementary blend of essential oil compounds with nature's most efficient organic acid (benzoic acid), to modulate the microbiota and stimulating the secretion of digestive enzymes. Crina® Digest was introduced in EMEA and will be expanded to other geographies over time.

In September, we announced the launch of Balancius™, a major breakthrough in animal nutrition. Optimizing gastrointestinal functionality is crucial for efficient feed utilization, for example in poultry farming. Balancius™ is a naturally occurring muramidase, an enzyme that removes bacterial debris from the gut and significantly increases feed efficiency and digestibility. Balancius™ is currently registered for broilers in Brazil, Argentina, Chile, Colombia, Costa Rica, Mexico, the US, Bangladesh, Pakistan, India, South Africa and Nigeria. Registration in the EU is to follow in 2019.

In the ruminant sector, the beef market saw significant growth opportunities in the US, Eastern Europe, Asia, Argentina and Brazil. In 2018, our core portfolio registered strong growth, stimulated by the vitamins market and the reinforcement of our positioning of Hy-D® in the vitamin D segment through the recent approval of Hy-D® Ruminant in the US. Hy-D® is a vitamin D3 metabolite that supports bone development, muscle formation and immune response. Having been successfully used in poultry and swine, it is now being extended to ruminants.

The aquaculture business also showed strong growth in 2018, driven by the continued increase of salmon consumption in the end-markets.

In the pet food industry, the increasing trend to treat pets as part of the family has driven up product standards through the use of more expensive functional ingredients, which has translated into higher pricing. Marketing and product labeling trends are mirroring those observed in human nutrition and consumer goods. These trends are driving growth in the US, Europe, and Japan especially.

In terms of our regional presence, our business enjoyed strong growth in Asia Pacific during 2018, led by South East Asia. In October, we expanded our operations in India with the opening of a second Animal Nutrition & Health premix plant in Jadcherla (India). By opening this facility, we underline our commitment to meeting the global feed industry's need for innovative and sustainable solutions. It testifies to our growing global presence.

We saw continuous growth in China, with a strong focus on digital solutions, driven by Chinese tech companies entering the farming business.

In Latin America, we continued to invest in our premix network, opening a new premix plant in Lurín, near Lima (Peru).

In EMEA, our biggest region, western Europe remained a solid source of revenue, capitalizing on the integration of Twilmij. Our business also enjoyed growth in southern Europe, with increasing penetration in Northern Africa and a portfolio expansion in the Middle East.

In North America, we captured the growth opportunities created by the vitamins market.

In 2018, we launched a holistic multi-year transformation program called acCElerate to further strengthen our market position and sustain our organic above-market growth track-record.

In 2018, we made significant progress in Veramaris®, our joint venture with Evonik to produce the omega-3 fatty acids EPA and DHA from natural marine algae as an alternative to fish-oil-based omega-3. Norwegian salmon producer Lingalaks AS has started to replace fish oil by feeding 50 percent of their salmon a diet which includes omega-3 oil produced by Veramaris®, in order to ensure greater sustainability and differentiation of their products.

We also made good progress with Project Clean Cow, our new, highly innovative, feed solution that reduces methane emissions from cattle by more than 30%. We have successfully gathered the data needed to apply for regulatory approvals in our targeted launch markets for this project.

Human Nutrition & Health

Highlights 2018

- Strong year, continued good sales across regions and segments, especially in dietary supplements

- Acquisition of a significant equity stake in Mixfit

- Start of construction of world's only premix site exclusively serving early life nutrition market

- Integration of BioCare, our probiotic expert

Human Nutrition & Health reported sales of €2,019 million in 2018 versus €1,939 million in 2017. Our Human Nutrition & Health business delivered a strong year, with 7% organic growth and 4% volume growth. All regions and segments continued to perform well, with especially strong growth in dietary supplements, i-Health and the pharma segment. Early life nutrition showed solid performance in all regions. Construction started on our second premix solutions facility in Poland, which will be exclusively dedicated to the maternal and infant nutrition market. Sales to food & beverages continued to develop well, driven by tailored multiple-ingredient premix solutions, supported by marketing & sales excellence and local application know-how.

Human Nutrition & Health provides solutions for the food & beverage, dietary supplements, early life nutrition, medical nutrition, nutrition improvement and active pharmaceutical ingredient (API) markets. We serve these industries with vitamins, nutritional lipids, carotenoids, nutraceuticals and custom nutrient premixes. i-Health — a global consumer health and wellness company and subsidiary of DSM — develops, markets and distributes branded products that support health and wellness. Core categories include probiotics, healthy aging, and urinary health.

Our increasingly customer-centric way of operating was a key factor behind the growth of our sales during 2018. We delivered this result via market-segment-focused, customer-intimate, strategic market plans.

In 2018, we once again demonstrated our ability to organically outgrow our markets and further improve our margins thanks to our unique business model and an increasing focus on customer-centricity.

Chris Goppelsroeder, DSM Executive Committee and President & CEO DSM Nutritional Products

Our business is also moving closer to the consumer in the value chain, focusing more intensely on the business-to-consumer and personalized nutrition sectors. A growing proportion of our revenue — more than 40% — now comes from custom nutrient premixes, market-ready solutions and direct-to-consumer products that address diverse health or lifestyle benefits.

Our collaboration with digital health company Mixfit to deliver personalized nutrition solutions unites our expertise in micronutrients with Mixfit's proprietary technology, creating the ability to analyze health data in real time. In May, Mixfit launched the prototype of its Intelligent Nutrition Assistant (Mina). Mina analyzes a person's genetic makeup, diet, lifestyle and health goals to create and dispense beverages containing a customized mix of our vitamin and mineral Quali®-Blends throughout the day. In July, we became Mixfit's largest shareholder. The US launch of Mixfit is scheduled for the second quarter of 2019.

In April, we made an investment in Tespo, a US-based start-up that offers consumers a simpler way to take vitamins by providing these in a pill-free, liquid format dispensed at home.

During the year, we also acquired a venturing stake in Biomarker Labs. The Biomarker app streamlines health information from practically any wearable, sensor, lab or health app to measure any dietary supplement brand to tell what's working, and what is not.

In August, we announced plans for the world's only premix manufacturing facility created exclusively for the maternal and infant nutrition market. Located in Buk (Poland) at our existing premix site, the investment is expected to double production output at the site within the next two years. The design incorporates several advanced technologies that reflect the specialist needs of the early life nutrition market.

Following the addition of probiotics to our gut health offering via the acquisition of BioCare in December 2017, we integrated this business. BioCare is now our probiotic expert, providing a 360-degree experience to customers.

Personal Care & Aroma Ingredients

Highlights 2018

- Above-market growth in both personal care and aroma ingredients

- Implementation of new business unit strategy based on three key growth drivers

- Launch of new innovations in skin and sun care

Sales were €382 million in 2018, from €353 million in 2017, up 8%, with very strong 11% organic growth, partly offset by 3% less favorable currencies. All personal care product lines, including sun, skin and hair care, delivered good above-market growth, while aroma ingredients performed very strongly in 2018. Successful commercialization of the innovation pipeline further contributed to a very good year for the business.

Personal Care & Aroma Ingredients offers solutions for customers in the personal care, home care and fine fragrance markets. Our extensive portfolio includes aroma ingredients, vitamins and natural bio-actives, as well as UV filters, peptides and polymers. Our solutions support the health and beauty needs of an aging population with various skin and hair types around the world, and address increasing concerns around global public health issues such as air pollution and skin cancer.

Building on strong growth during 2017, we enjoyed continued growth in both personal care and aroma ingredients in 2018, outpacing the market across all segments. Leveraging three main growth drivers — strategic initiatives in core segments, commercialization of our innovations, and external partnerships — we implemented our new business unit strategy during 2018. Underpinned by a heightened focus on operational excellence and sustainability, this strategy aims to further accelerate our growth.

In 2018, we launched BEL-EVEN™, a patented synthetic molecule that helps counteract the damaging effects of stress on skin by inhibiting the enzyme that generates cortisol in the skin. We also unveiled new research on SYN®-HYCAN, a patented cosmetic tripeptide with scientifically proven volumizing and firming benefits for all key facial zones.

We also introduced a new grade of vitamin B3 — Niacinamide PC, guaranteed to contain less than 100 ppm residual nicotinic acid, making it exceptionally well tolerated. Proprietary research by DSM revealed that it could prove to be a powerful ally in the latest challenges facing the beauty industry: environmental pollution and ubiquitous blue light.

In line with our long-term commitment to transparency, we obtained well-known certifications such as COSMOS and NATRUE, and more than 45% of DSM's portfolio is of natural origin according to the recently introduced ISO 16128 standard on definitions for natural ingredients. To address the growing interest in natural products, we launched DSM's House of Naturals — an easy-to-use navigation aid that offers customers clarity about the degree of natural origin in our ingredients. Almost half of our Personal Care & Aroma Ingredients portfolio is of natural origin, and more than 70% of our skin care actives have a natural origin content in excess of 90%.

DSM Food Specialties

Highlights 2018

- Good sales growth in hydrocolloids, enzymes and cultures

- New product introductions supporting health & wellness trends

- Growth in beverages and solutions for cheese

- Announcement of joint venture with Cargill to bring zero-calorie, cost-effective sweeteners to market faster

In 2018, total sales were 9% lower compared to 2017, due to the deconsolidation of Yantai Andre Pectin and negative currency effects. Good sales growth rates in hydrocolloids, enzymes and cultures were partly offset by soft sales in savory ingredients as a result of capacity limitations early in the year that prevented the business from fully capitalizing on the positive market conditions. This resulted in overall organic growth of 1%.

DSM Food Specialties is a leading global supplier of specialty food enzymes, cultures, probiotics, bio-preservation solutions, hydrocolloids, savory ingredients, and solutions for sugar reduction. Our ingredients and solutions are widely used to create a broad range of food products, from grocery favorites like yogurt, cheese and soups to specialized products including gluten-free bread and beer, meat substitutes, lactose-free milk, and sugar-reduced beverages.

Demand for our products is driven by five main market trends: sugar reduction, enhanced taste experience, improved health and wellness, bio-preservation, and food chain efficiency. With nearly 150 years of experience in biotechnology and fermentation for the food industry, we aim to enable better food for everyone, helping make existing diets healthier and more sustainable, and giving increasing numbers of people around the world access to affordable, quality food.

At the start of 2018, we adopted a customer-centric organizational structure at DSM Food Specialties, switching from a product-led to a market-focused model for our commercial operations. This aims to make us better aligned with customers and their needs in the dairy, baking, beverages, and savory industries we serve.

In dairy, we introduced Maxilact® Smart, the fastest-acting lactase enzyme on the market. Boosting throughput speeds enables customers to improve their efficiency in producing lactose-free or reduced-sugar products, for which consumer demand is growing worldwide. In support of the trend toward clean labels and away from chemical preservatives, we made our core range of cheese enzymes completely benzoate-free.

In baking, legislation in Europe imposed benchmark levels of acrylamide in baked goods and snacks due to health concerns. This drove demand for our PreventASe® enzyme, which we supported with the introduction of PreventASe® XR, a solution created to deliver improved efficacy in applications such as corn chips, biscuits and crackers.

One of the important trends underpinning our good performance in beverages is the drive by many of the world's leading brewers to reduce their environmental footprint, in particular to lower greenhouse gas emissions. Our enzymatic solutions — including Brewers Clarex® and Brewers Compass®, which enable significant energy savings — are consequently in high demand.

Solutions such as ModuMax™ enable food and beverage producers to deliver an enjoyable taste experience in low-sugar, low-salt, and low-fat applications by creating a fuller mouthfeel and masking negative off-notes. Customer traction for this innovative taste modulator continued to grow during 2018.

One of our major innovation programs over recent years has been the development of fermentation-derived steviol glycosides — the sweet-tasting, zero-calorie molecules from the stevia plant. After a successful initial market introduction in North America in mid-2018, we accelerated our large innovation project for fermentative ‘Stevia' by establishing a joint venture with Cargill, announced in November. Stevia is a zero-calorie, cost-effective sweetener that can substitute sugar in food and beverages.

Another growth platform in specialty food ingredients is hydrocolloids — thickeners and stabilizers that dissolve, disperse or swell in water to provide a broad range of important functionalities and physical attributes including gelling, texture, mouthfeel, viscosity and suspension. Demand for hydrocolloids, especially our natural hydrocolloids, is driven by three underlying consumer trends:

- The quest for convenient foods and beverages

- Consumers' increasing demand for dairy- and plant-based protein drinks

- The trend toward clean labeling

Our hydrocolloids are primarily delivered in the form of pectin and bio-gums. Both are used as gelling and stabilizing agents in a variety of foods and beverages. Our natural hydrocolloids are enjoying strong sales growth.

In July 2018, we restarted production in DSM Rainbow Biotechnology (DRB), a company in which we acquired a majority equity stake in September 2017, thereby further increasing our gellan gum capabilities and expanding into other bio-gums such as xanthan and welan. Following the completion of the transaction, the site was shut down so that we could execute a series of upgrades to improve its safety, health, quality and environmental standards. With these investments, DRB will substantially improve the robustness of its operations, as well as the reliability and quality of its products and supply. DRB in future will work closely with our other bio-gums site, DSM Zhongken Biotechnology, as well as with the new Innovation Center, both in Tongxiang (Zhejiang Province, China).