Strategy 2018

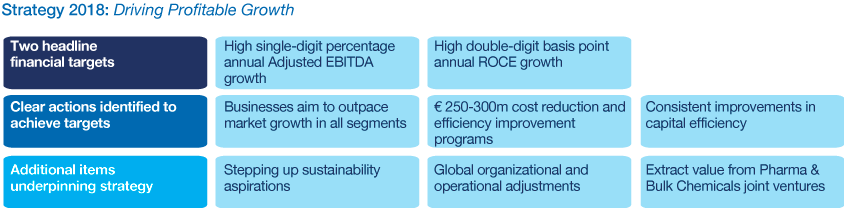

In 2015, we communicated our three-year strategy called Strategy 2018: Driving Profitable Growth, which has a strong focus on capturing the full potential of our new business portfolio after the extensive transformation that occurred in the period 2010–2015 and translating this into strong financial results.

Strategy 2018 had two headline financial targets: high single-digit percentage annual Adjusted EBITDA growth and high double-digit basis point annual ROCE growth.

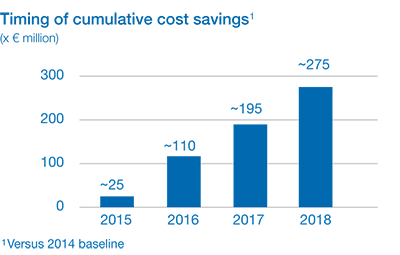

To deliver on these targets, we defined clear actions, including outpacing market growth, cost reduction and efficiency improvements, and making a continuous push for consistent improvements in capital efficiency. We initiated extensive cost-reduction and improvement programs with the aim to deliver €250–300 million in cost savings by the end of the strategic period versus the 2014 baseline.

We have become a growth company with ambitious sustainability efforts across the three dimensions of People, Planet and Profit.

Philip Eykerman, DSM Executive Committee

We successfully executed our strategy. With a very strong 2018, we have outperformed our ambitious financial and sustainability targets. We delivered strong organic growth, with greatly improved operational and financial performance and with significant value creation in all our businesses. In addition, we took important steps to monetize our non-core Pharma and Bulk Chemicals joint ventures. Even considering the additional profitability in the Nutrition business driven by an exceptional temporary vitamin effect, 2018 was a strong year.

For the strategic period 2016–2018, we:

- Outperformed on our financial targets on Adjusted EBITDA growth and ROCE growth

- Outpaced market growth in both Nutrition and Materials

- Created a strong and focused innovation pipeline to enhance long-term growth

- Executed extensive cost-reduction and improvement programs which delivered run-rate cumulative savings of ~€275 million at the end of 2018 versus the 2014 baseline

- Achieved improvements in capital efficiency

- Extracted significant value from our joint venture partnerships Patheon, ChemicaInvest and DSM Sinochem Pharmaceuticals. The combined proceeds of these divestments were around €3 billion. We plan to divest our remaining minority shares in AOC Aliancys (18.9%) and AnQore (35%) in the coming period

- Strengthened the organization, enabling a stronger result-oriented company and culture

Another key part of the strategy was to continue to strengthen our commitment to sustainability by:

- Reducing our own environmental footprint

- Enabling other stakeholders, especially our customers, to be more sustainable

- Advocating on key areas of competence by actively raising awareness and sharing knowledge

By doing so, we continued to work toward the United Nations Sustainable Development Goals, especially SDG 2 (Zero Hunger), SDG 3 (Good Health and Well-being), SDG 7 (Affordable and Clean Energy), SDG 12 (Responsible Production and Consumption) and SDG 13 (Climate Action). For more information, see DSM and the Sustainable Development Goals and throughout this Report.

During the execution of our Strategy 2018, we continually monitored, assessed and responded appropriately to societal, macroeconomic and segment-specific developments as they occurred. Our approach to managing both opportunities and risks in our businesses is embedded in our operating and governance model and risk management approach. For more information, see Corporate governance and Risk management.

Strategy 2018 successfully delivered

Total DSM financial results

We significantly outperformed our financial targets in 2018. Even considering the estimated impact of the temporary vitamin effect, caused by an extraordinary supply disruption in the industry, we have delivered strong results. In the underlying business, we achieved 6% organic growth compared to 2017, with €8,852 million in sales. The Adjusted EBITDA from underlying business was up 6% from 2017, to €1,532 million. Adjusted for currencies, our growth was 10%, above our high single-digit percentage target. Our Return On Capital Employed (ROCE) from underlying business was up 100 basis points, to 13.3%, versus our target of high double-digit basis points.

Including the estimated temporary vitamin effect, we realized €9,267 million in sales compared to €8,632 million in 2017, a 7% increase. We achieved a 26% total Adjusted EBITDA growth, up to €1,822 million from €1,445 million in 2017. Our ROCE was 16.8%, up 450 basis points from the previous year. Net profit was €1,079 million.

Over the strategic period 2016–2018, we consistently outperformed our targets. We realized an average Adjusted EBITDA growth of 13% against an average high single-digit percentage yearly target. The same goes for the average high double-digit basis point ROCE growth, which was 190 basis points per year over the period 2016–2018.

In 2018, we delivered strong organic growth, with greatly improved operational and financial performance and significant value creation in all our businesses. Both our Nutrition and Materials businesses contributed to this strong performance. Nutrition's broad, global portfolio in food and feed ingredients, as well as its expanded portfolio of solutions, drove strong growth. Meanwhile, Materials continued its 'silent transformation', successfully focusing on higher-growth, higher-margin, specialty segments and delivering higher-performing solutions that are innovative, safe and lightweight, as well as being more sustainable and environmentally friendly.

|

Financial targets 2016–2018

|

Realization

|

|

|---|---|---|

|

2018

|

2017

|

|

|

High single-digit percentage annual Adjusted EBITDA growth

|

||

|

- based on underlying business

|

6%

|

15%

|

|

- total business

|

26%

|

15%

|

|

High double-digit bps annual ROCE growth

|

||

|

- based on underlying business

|

100 bps

|

190 bps

|

|

- total business

|

450 bps

|

190 bps

|

For detailed information on DSM's group financial results in 2018, see Profit.

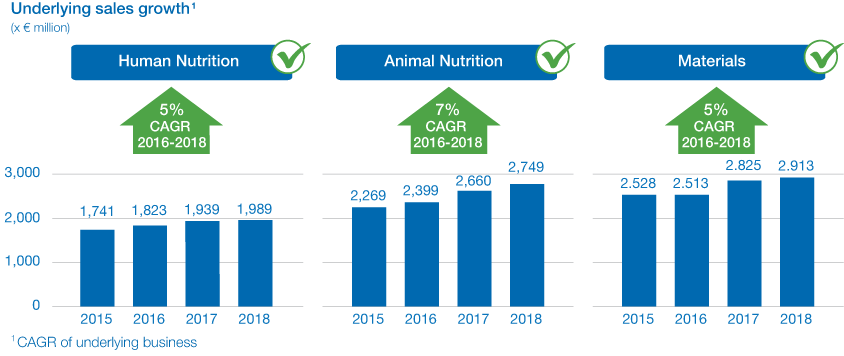

Nutrition financial results

Our Nutrition business performed strongly, benefiting from a temporary exceptional vitamin effect caused by supply disruptions in the industry. The total temporary vitamin effect was estimated at €415 million for the year, mainly in Animal Nutrition & Health. Sales in the underlying business were up 3% to €5,722 million. The organic sales growth in the underlying business was 7%, with strong volumes, up 4%, as well as price growth of 3%. Nutrition sales growth including temporary vitamin effect, was 10%.

Nutrition continued to deliver on its aspired above-market growth ambition through further leveraging its unique global products and local solutions business model, supported by marketing and sales excellence and customer-led innovation.

Animal Nutrition & Health delivered a strong year, with 8% organic growth in the underlying business versus 2017. This good growth was achieved against a tough comparative year. Business conditions were favorable in almost all regions. Sales to Brazil were softer due to temporary shutdowns, mainly caused by strikes in the second quarter. Prices in the underlying business increased by 4%, driven by pricing initiatives to mitigate higher costs of sourced ingredients and the impact of negative exchange rates. Furthermore, prices were supported by the effects of the 'Blue Skies' policies in China.

Our Animal Nutrition & Health business continued to benefit from our ability to address a wide range of species, as well as from a diversified geographical presence. Markets in animal feed were favorable, with strong demand for poultry, pork and salmon.

Human Nutrition & Health delivered a strong year, with 7% organic growth and 4% volume growth. All regions and segments continued to perform well with an especially strong growth in dietary supplements, i-Health and the pharma segment. Early life nutrition showed solid performance in all regions. Construction started on our second premix solutions facility in Poland, which will be exclusively dedicated to the maternal and infant nutrition market. Sales to food & beverages continued to develop well, driven by tailored multiple-ingredient premix solutions, and supported by marketing & sales excellence and local application know-how. Prices were up by 3%, driven by a combination of a favorable mix due to strong growth in premix and i-Health, as well as benefits from higher prices for premix and advanced formulations, supported by the effects of the 'Blue Skies' policies in China.

In Food Specialties, sales were 9% lower compared to 2017, due to the deconsolidation of Yantai Andre Pectin and negative currency effects. Good sales growth rates in hydrocolloids, enzymes and cultures were partly offset by soft sales in savory ingredients as a result of capacity limitations early in the year that prevented the business from fully capitalizing on the positive market conditions. This resulted in an overall organic growth of 1%.

After a successful initial market introduction in North America in mid-2018, we accelerated our large innovation project for fermentative Stevia by establishing a joint venture with Cargill, as announced last November. Stevia is a zero-calorie, cost-effective sweetener that can substitute sugar in food and beverages.

In Personal Care & Aroma Ingredients, sales were up 8%, with a very strong 11% organic growth, partly offset by 3% less favorable currencies. All personal care product lines, including sun, skin and hair care delivered good above-market growth, whereas aroma ingredients performed very strongly in 2018. Successful commercialization of the innovation pipeline further contributed to a very good year for the business.

For Nutrition, the Adjusted EBITDA growth in the underlying business was up 6% to €1,117 million compared to the previous year. This was driven by strong volume growth, pricing strength, and contributions from the savings and efficiency improvement programs, partly offset by significant negative foreign exchange effects. The Adjusted EBITDA margin in the underlying business was 19.5%, compared to 18.9% in 2017. The Adjusted EBITDA for total Nutrition was €1,407 million, up 34% from the previous year, including the estimated total temporary vitamin effect of €290 million, mainly in Animal Nutrition & Health. The Adjusted EBITDA margin for total Nutrition was 22.9% in 2018, compared to 18.9% in 2017. Over the strategic period, the Adjusted EBITDA was consistently over our aspired range of 18–20%.

Materials financial results

In 2018, our Materials business reported 5% organic sales growth, driven by an increase of 2% in volumes and 3% in prices, mainly reflecting commercial pricing initiatives aimed at offsetting higher raw material costs.

DSM Engineering Plastics and DSM Resins & Functional materials delivered 7% and 2% organic growth respectively. The good business conditions and strong end-market demand started to soften in the second half of the year, with some destocking in the value chain at year-end. DSM Dyneema had a very strong performance throughout 2018, with 6% organic growth, driven by continued high demand in personal protection. To fulfill the growing demand, the business started constructing additional production lines in the USA and in the Netherlands.

Total Adjusted EBITDA was up 5% in 2018 to €512 million, driven by good volume growth and our continuous shift toward a specialty portfolio, and despite a negative currency impact of 2%. The portfolio's silent transformation was also reflected in the 2018 Adjusted EBITDA margin of 17.6%, versus 17.3% in 2017.

Innovation results

The DSM Innovation Center has multiple functions within DSM, including accelerating the innovation power of our core businesses and extracting value from our Emerging Business Areas (EBAs). At DSM, we want at least ~20% of our sales to come from innovation sales, which we define as sales from products and solutions introduced in the last five years. In 2018, innovation sales (underlying business) amounted to 19%. This is in line with our aspiration.

DSM Innovation Center sales were up 2%, with 5% organic sales growth largely offset by a weaker US dollar. DSM Biomedical volumes were up driven by strong sales in the drug delivery segment in the second half of the year. DSM Advanced Solar reported slightly lower volumes resulting from a slowdown in demand for solar panels following a policy change by the Chinese government to reduce the number of subsidized solar parks to be installed. DSM Advanced Solar introduced a new generation of solar backsheets which is being well received by the market. DSM Bio-based Products & Services made good progress in 2018, improving the robustness of the production technology for second-generation bio-ethanol and introducing a new generation of enzymes for first-generation bio-ethanol.

The Adjusted EBITDA was relatively stable compared to 2017. In the fourth quarter, we benefited from the collaboration and license agreement with Aerie Pharmaceuticals.

For more information on innovation and R&D, see Innovation.

|

2018

|

2017

|

|

|

Innovation sales underlying business1

|

19%

|

21%

|

|

High-growth economies underlying business1

|

43%

|

44%

|

1 Excluding temporary vitamin effect, see Key business figures at a glance

Balanced global footprint

Sales growth was strong among all regions, with favorable high double-digit growth in Western Europe and single-digit growth in North and Latin America. Sales were good in Latin America and China, despite some temporary shutdowns in Brazil. Solid growth was achieved in China, India and Eastern Europe. All high-growth economies together currently represent 43% of our sales, which is in line with 2017. The share of sales in these economies as a proportion of our total sales gives us a well-balanced global footprint.

Sustainability results

At DSM, sustainability is not only our core value and a key responsibility; it is also increasingly an important business driver that is fully engrained in our strategy, business and operations. Our approach for bringing about positive change is to reduce, enable and advocate.

We continued to further embed sustainability across all of our business activities, both in recognition of our responsibility to reduce our environmental footprint and to help our supply chain, customers and partners do the same. In particular, we focused on the areas of nutrition, climate and energy, and the circular and bio-based economy. In 2018, our Brighter Living Solutions accounted for 62% of sales (from underlying business). We are proud to be globally recognized for our leadership in this area. We are pleased to be named as the global leader in ESG (environmental, social and governance) within the chemicals industry by Sustainalytics for the second year in a row. We ranked number one of 135 companies. Our climate change strategy received an A- rating from CDP, the non-profit global environmental disclosure platform. We also maintained our high AA rating from MSCI. In addition, we topped the Dow Jones Sustainability World Index for the eighth time. This ranking means we will continue to have RobecoSAM Gold Class status in 2019.

To read more about our environmental performance, see Planet.

Organization and culture

We adjusted our global organizational and operating model to support our growth. To achieve our strategy, we set targets around employee safety, engagement and diversity.

Our people feel even more inspired, engaged and committed: our annual Employee Engagement Index rating increased from 75% in 2017 to a highest-ever score of 76% in 2018. Almost all elements of our Employee Engagement showed improvement. The most notable increases were seen in career opportunities and opportunities for learning and development.

We continued to focus on improving our performance in inclusion and diversity. Although our work in this area is far from done, it is pleasing to see that the percentage of female executives increased from 17% to 19%, making progress toward 25% by 2020. The number of under-represented nationalities at executive level increased to 60%, achieving our long-term aim of 60%. For more information, see People.

We worked on further improving our safety performance in 2018. We focused on keeping safety awareness high and we developed a new set of global leading performance indicators to help us to more proactively tackle safety observations and prevent incidents from occurring. The Frequency Index of all DSM Recordable Injuries improved from 0.36 to 0.33. However, in September 2018, a tragic accident took place at our Tortuga site in Pecém, Brazil, where one of our subcontractors lost his life when opening a container. This has deeply shocked us all. It demonstrates once again that Health and Safety must always remain our top priority, and that we must work to continuously improve our safety performance, day in, day out. For more information, see What still went wrong in 2018.

Extracting value from our partnerships

Acting on our commitment to monetize our remaining Pharma and Bulk Chemicals joint ventures, we divested our non-core participations in DSM Sinochem Pharmaceuticals and Fibrant in October 2018. Together with our cash generation, this all led to a net debt reduction in 2018 from €742 million to €113 million at year-end. We plan to divest our remaining minority shares in AOC Aliancys (18.9%) and AnQore (35%) in the coming period. Since 2015, we have monetized our non-core joint ventures in pharma (especially Patheon) and Fibre Intermediates for a total of about €3 billion. For more information, see Partnerships.

Strategy review process for the period beyond 2018

In 2018, having achieved EBITDA growth rates and improvements in return on capital employed above the original targets and having made good progress with innovation, cost reduction and efficiency programs at business level, as well as with monetizing our non-core assets, we brought forward our regular strategy review process. In June 2018, we launched Strategy 2021: Growth & Value - Purpose led, Performance driven, as outlined in the Strategy 2021 chapter.