Independent auditor's report

To: the Annual General Meeting of Shareholders and the Supervisory Board of Koninklijke DSM N.V.

Report on the audit of the financial statements 2019 included in the Integrated Annual Report

Our opinion

In our opinion:

the accompanying consolidated financial statements give a true and fair view of the financial position of Koninklijke DSM N.V. (hereafter: Royal DSM) as at 31 December 2019 and of its result and its cash flows for the year then ended, in accordance with International Financial Reporting Standards as adopted by the European Union (EU-IFRS) and with Part 9 of Book 2 of the Dutch Civil Code

the accompanying parent company financial statements give a true and fair view of the financial position of Royal DSM as at 31 December 2019 and of its result for the year then ended in accordance with Part 9 of Book 2 of the Dutch Civil Code

What we have audited

We have audited the financial statements 2019 of Royal DSM based in Heerlen. The financial statements include the consolidated financial statements and the parent company financial statements.

The consolidated financial statements comprise:

the consolidated balance sheet as at 31 December 2019

the following consolidated statements for 2019: the income statement, the statements of comprehensive income, changes in equity and cash flows

the notes comprising a summary of the significant accounting policies and other explanatory information

The parent company financial statements comprise:

the parent company balance sheet as at 31 December 2019

the parent company income statement for 2019

the notes comprising a summary of the accounting policies and other explanatory information

Basis for our opinion

We conducted our audit in accordance with Dutch law, including the Dutch Standards on Auditing. Our responsibilities under those standards are further described in the 'Our responsibilities for the audit of the financial statements' section of our report.

We are independent of Royal DSM in accordance with the 'Verordening inzake de onafhankelijkheid van accountants bij assurance-opdrachten' (ViO, Code of Ethics for Professional Accountants, a regulation with respect to independence) and other relevant independence regulations in the Netherlands. Furthermore, we have complied with the 'Verordening gedrags- en beroepsregels accountants' (VGBA, Dutch Code of Ethics).

We believe the audit evidence we have obtained is sufficient and appropriate to provide a basis for our opinion.

Audit approach

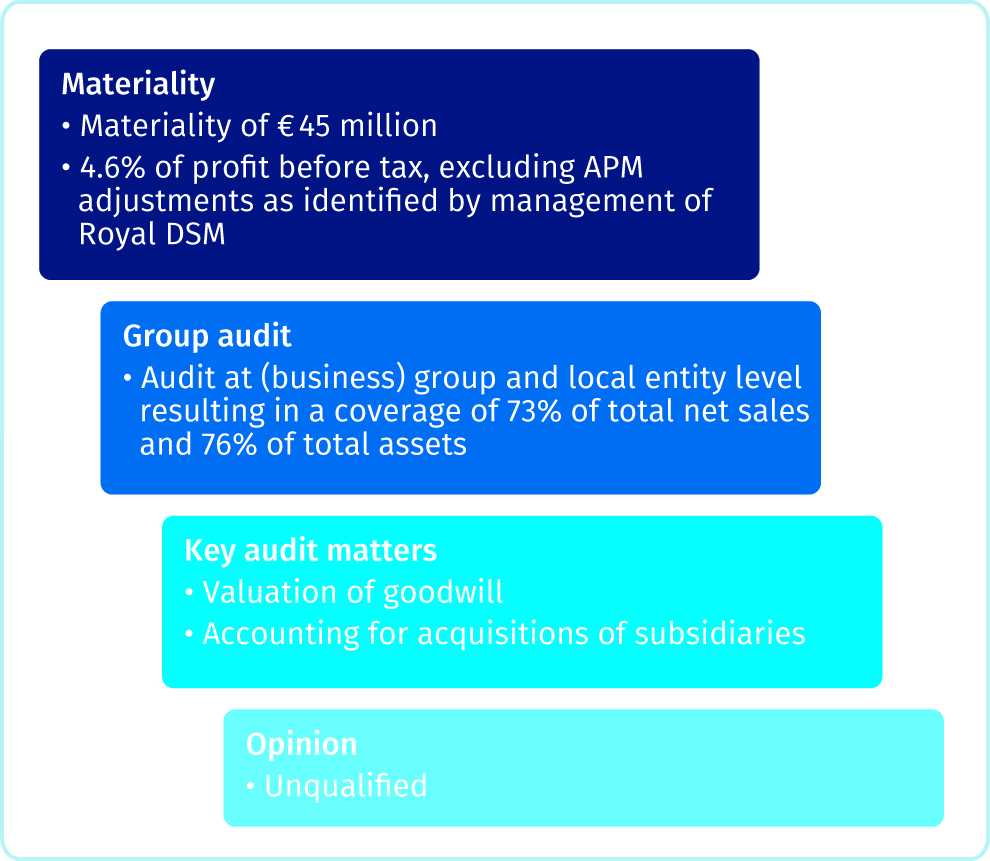

Summary

Materiality

Based on our professional judgement we determined the materiality for the financial statements as a whole at €45 million (2018: €40 million). The materiality is determined with reference to profit before tax, excluding APM adjustments as identified by management of Royal DSM, resulting in a percentage of 4.6% (2018: 3.2%). In addition, the appropriateness of the materiality was assessed by comparing the amount to consolidated net sales of which it represents 0.5% (2018: 0.4%). We have also taken into account misstatements and/or possible misstatements that in our opinion are material for the users of the financial statements for qualitative reasons.

We agreed with the Supervisory Board that misstatements in excess of €2 million (2018: €1.5 million) which are identified during the audit, would be reported to them, as well as smaller misstatements that in our view must be reported on qualitative grounds.

Scope of the group audit

Royal DSM is at the head of a group of reporting entities (hereafter: entities). The financial information of this group is included in the financial statements of Royal DSM.

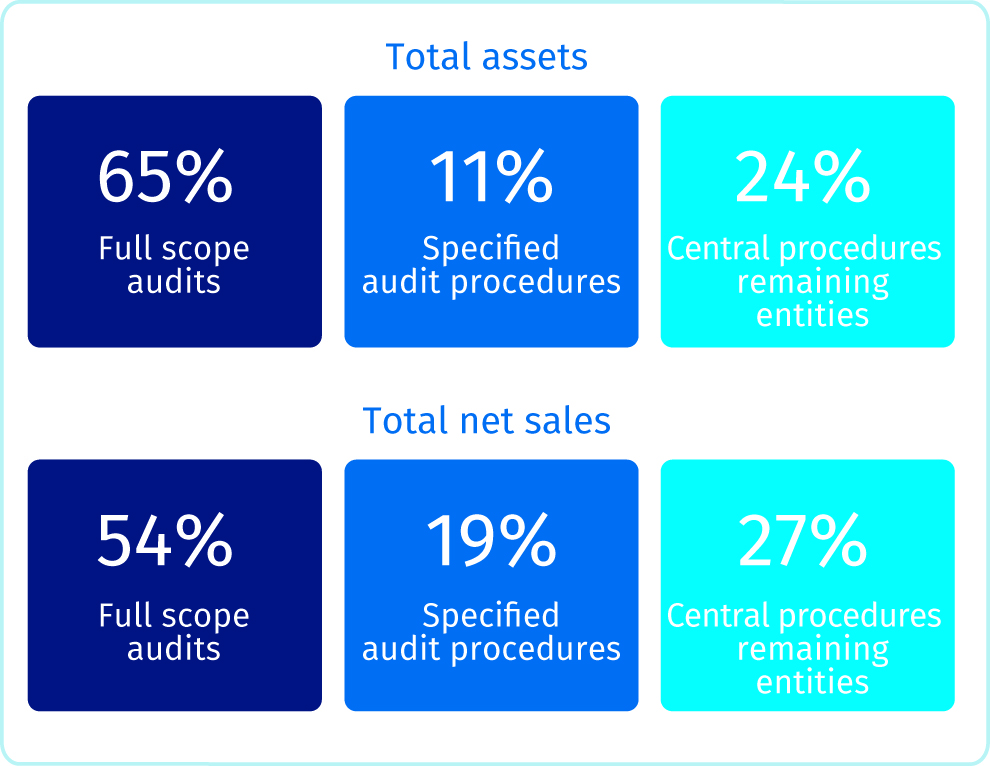

Because we are ultimately responsible for the auditor's report, we are also responsible for directing, supervising and performing the group audit. In this respect we have determined the nature and extent of the audit procedures to be carried out for entities reporting for group audit purposes. Decisive were the size and/or the risk profile of the entities or operations. On this basis, we selected 22 entities (2018: 22 entities) to perform audits for group reporting purposes on a complete set of financial information. In addition, we selected 14 entities (2018: 17 entities) to perform specified audit procedures for group reporting purposes on specific items of financial information.

This resulted in a coverage of 73% (2018: 73%) of total net sales and 76% (2018: 80%) of total assets. The remaining 27% of total net sales (2018: 27%) and 24% of total assets (2018: 20%) is represented by a significant number of entities ('remaining entities'), none of which individually represents more than 2% of total net sales and 2% of total assets.

For these remaining entities, we performed among others analytical procedures at (business) group level to validate our assessment that there are no risks of material misstatement within these entities.

Our procedures as described above can be summarized as follows:

We have:

performed audit procedures ourselves at (business) group level in respect of areas such as the annual goodwill impairment tests, other asset impairment assessments, accounting for associates and joint ventures including acquisitions and divestments, valuation of deferred tax assets, acquisitions of subsidiaries, restructuring provisions, treasury and shared service centers

used the work of local KPMG auditors when auditing financial information or performing specified audit procedures at business group and local entity level

The group audit team has set materiality levels for the entities, which ranged from €5 million to €12.5 million (2018: €5 million to €12.5 million), based on the mix of size and risk profile of the entities within the group.

The group audit team provided detailed instructions to all business group and local entity auditors part of the group audit, covering the significant audit areas, including the relevant risks of material misstatement, and the information required to be reported back to the group audit team. The group audit team visited local entity auditors and entity locations in the United States of America, Switzerland, China, United Kingdom and the shared service center in India.

Telephone conferences were held with all local entity auditors part of the group audit. During these visits and telephone conferences, we discussed the audit approach and the audit findings and observations reported to the group audit team. For a number of these entities we also performed audit file reviews.

By performing the procedures mentioned above, together with additional procedures at (business) group level, we have been able to obtain sufficient and appropriate audit evidence about the group's financial information to provide an opinion about the financial statements.

Audit scope in relation to fraud

In accordance with the Dutch standards on auditing we are responsible for obtaining a high (but not absolute) level of assurance that the financial statements taken as a whole are free from material misstatement, whether caused by fraud or error.

As part of our risk assessment process we have evaluated events or conditions that indicate an incentive or pressure to commit fraud or provide an opportunity to commit fraud ('fraud risk factors') to determine whether fraud risks are relevant to our audit. During this risk assessment we made use of our own forensic specialist.

We communicated identified fraud risks within our team and remained alert to any indications of fraud throughout the audit. This included communication from the group to local entity audit teams of relevant fraud risks identified at group level.

In accordance with the auditing standard we evaluated the fraud risks that are relevant to our audit:

fraud risk in relation to revenue recognition, specifically being the risk of manual override with respect to the cut-off of revenue in the period close to the financial year-end (the presumed risk)

fraud risk in relation to management override of controls to meet targets and/or expectations (the presumed risk)

Our audit procedures included an evaluation of the design and implementation of internal controls relevant to mitigate these fraud risks and supplementary substantive audit procedures. This included inquiries of management, detailed testing of high risk journal entries and an evaluation of key estimates and judgment by management, such as estimates relating to goodwill impairment testing and accounting for the acquisition of subsidiaries. Furthermore, in relation to the correct recognition of revenues for the period close to the financial year-end, we carried out inspection and testing of documentation such as agreements with customers and shipping documents.

In determining the audit procedures we made use of the evaluation of management of Royal DSM in relation to fraud risk management (prevention, detection and response), including the set-up of ethical standards to create a culture of honesty.

As part of our evaluation of any instances of fraud, we inspected the incident register/whistle blowing reports and follow up by management.

We communicated our risk assessment and audit response to the Managing Board and the Supervisory Board. Our audit procedures differ from a specific forensic fraud investigation, which investigation often has a more in-depth character.

Our audit is based on the procedures described in line with applicable auditing standards and are not primarily designed to detect fraud.

Audit scope in relation to non-compliance with laws and regulations

We have made an assessment of laws and regulations that are relevant to Royal DSM. In this assessment we made use of our own forensic specialist.

We identified laws and regulations that could reasonably be expected to have a material effect on the financial statements based on our general understanding and sector experience, through discussion with relevant management and evaluating Royal DSM's policies and procedures regarding compliance with laws and regulations.

We communicated identified laws and regulations within our team and remained alert to any indications of non-compliance throughout the audit. This included communication from the group audit team to local entity audit teams of relevant laws and regulations identified at group level.

The potential effect of these laws and regulations on the financial statements varies considerably:

Firstly, Royal DSM is subject to laws and regulations that directly affect the financial statements, in particular corporate income taxation and financial reporting (including related Company legislation). We assessed the extent of compliance with these laws and regulations as part of our procedures on the related financial statement items

Secondly, Royal DSM is subject to many other laws and regulations where the consequences of non-compliance could have an indirect material effect on amounts recognized or disclosures provided in the financial statements, or both, for instance through the imposition of fines or litigation

Based on Royal DSM's nature of operations and their geographical spread, the areas that we identified as those most likely having such an indirect effect include laws and regulations regarding employment, health and safety, products, environmental and anti-competition.

Auditing standards limit the required audit procedures to identify non-compliance with laws and regulations that have an indirect effect to inquiring of relevant management and inspection of regulatory and legal correspondence, if any. Through these procedures, we did not identify any additional actual or suspected non-compliance other than those already identified by Royal DSM in each of the above areas. We considered the effect of actual or suspected non-compliance as part of our procedures with respect to provisions and disclosures of contingent liabilities.

Our audit is not primarily designed to detect non-compliance with laws and regulations and note that management is responsible for such internal control as management determines is necessary to enable the preparation of the financial statements that are free from material misstatement, whether due to fraud or error, including compliance with laws and regulations.

The more non-compliance with indirect laws and regulations (irregularities) is distant from the events and transactions reflected in the financial statements, the less likely the inherently limited procedures required by auditing standards would identify such instances. In addition, as with any audit, there remained a higher risk of non-detection of irregularities, as these may involve collusion, forgery, intentional omissions, misrepresentations, or the override of internal controls.

Our key audit matters

Key audit matters are those matters that, in our professional judgement, were of most significance in our audit of the financial statements. We have communicated the key audit matters to the Managing Board and the Supervisory Board. The key audit matters are not a comprehensive reflection of all matters discussed.

These matters were addressed in the context of our audit of the financial statements as a whole and in forming our opinion thereon, and we do not provide a separate opinion on these matters.

Compared to last year we have added as a key audit matter the accounting for acquisitions of subsidiaries as the acquisitions closed in 2019 on an accumulated basis are significant for the financial statements. Last year's key audit matter about the divestment of DSM Sinochem Pharmaceuticals is not included anymore in 2019, given the one-off nature of the divestment.

Valuation of goodwill

Description

Royal DSM carries a significant amount of goodwill in the balance sheet. In accordance with the group's accounting policies Royal DSM is required to test the amount of goodwill for impairment at least annually. The impairment tests were significant to our audit due to the complexity of the assessment process and judgments and assumptions involved which are affected by expected future market and economic developments.

Our response

We evaluated the design and implementation of controls with respect to Royal DSM's impairment testing process. We challenged the cash flow projections included in the annual goodwill impairment tests. Our audit procedures included, among others, the involvement of a valuation specialist to assist us in evaluating the assumptions, in particular the terminal growth and pre-tax discount rates, and the valuation methodology used by Royal DSM. We furthermore assessed the appropriateness of other data used, by comparing them to external and historical data, such as external market growth expectations and by analysing sensitivities in Royal DSM's valuation model. We specifically focused on the sensitivity in the available headroom for the cash generating units. By doing so, we assessed management's evaluation whether a reasonably possible change in key assumptions could cause the carrying amount to exceed its recoverable amount. Furthermore, we assessed the historical accuracy of management's estimates. Finally, we assessed the adequacy of the disclosure (Note 8) to the financial statements.

Our observation

We consider management's key assumptions and estimates to be within the acceptable range and we assessed the disclosure (Note 8) to the financial statements as being proportionate.

Accounting for acquisitions of subsidiaries

Description

During 2019, Royal DSM closed multiple acquisitions of subsidiaries, of which Andre Pectin was the most significant acquisition. The acquisitions involved a total consideration of EUR 585 million. These acquisitions had an aggregated impact on Goodwill and Intangible assets of EUR 338 million and EUR 125 million respectively. The acquisitions were significant to our audit due to the complexity of purchase price accounting and related judgments and assumptions such as the fair values of assets and liabilities acquired.

Our response

We inspected the agreements and other documents underlying the acquisitions to gain an understanding of the contractual terms and conditions to assess the consideration and the acquired identifiable assets and liabilities. We obtained the reports from the external valuation experts engaged by Royal DSM to assist management with the purchase price accounting and the identification of identifiable assets and liabilities in the respective business combinations. We involved a valuation specialist ourselves to evaluate management's valuation methodologies, and assumptions used such as growth rates and discount rates to arrive at the fair value of assets and liabilities recognised in the purchase price allocation. Our assessment of key assumptions used by management included a comparison with available external data. We also evaluated the adequacy of the disclosure (Note 3) of the acquisitions in the financial statements.

Our observation

We consider that the acquisitions are appropriately reflected in the financial statements. Management's key assumptions and estimates are within the acceptable range and we assessed the disclosure (Note 3) to the financial statements as being proportionate.

Report on the other information included in the Integrated Annual Report

In addition to the financial statements and our auditor's report thereon, the Integrated Annual Report contains other information.

Based on the following procedures performed, we conclude that the other information:

is consistent with the financial statements and does not contain material misstatements

contains the information as required by Part 9 of Book 2 of the Dutch Civil Code.

We have read the other information. Based on our knowledge and understanding obtained through our audit of the financial statements or otherwise, we have considered whether the other information contains material misstatements.

By performing these procedures, we comply with the requirements of Part 9 of Book 2 of the Dutch Civil Code and the Dutch Standard 720. The scope of the procedures performed is substantially less than the scope of those performed in our audit of the financial statements.

The Managing Board is responsible for the preparation of the other information, including the information as required by Part 9 of Book 2 of the Dutch Civil Code.

Report on other legal and regulatory requirements

Engagement

We were engaged by the Annual General Meeting of Shareholders as auditor of Royal DSM on 7 May 2014, as of the audit for the year 2015 and have operated as statutory auditor ever since that financial year.

No prohibited non-audit services

We have not provided prohibited non-audit services as referred to in Article 5(1) of the EU Regulation on specific requirements regarding statutory audits of public-interest entities.

Description of responsibilities regarding the financial statements

Responsibilities of the Managing Board and the Supervisory Board for the financial statements

The Managing Board is responsible for the preparation and fair presentation of the financial statements in accordance with EU-IFRS and Part 9 of Book 2 of the Dutch Civil Code. Furthermore, the Managing Board is responsible for such internal control as the Managing Board determines is necessary to enable the preparation of the financial statements that are free from material misstatement, whether due to fraud or error.

As part of the preparation of the financial statements, the Managing Board is responsible for assessing Royal DSM's ability to continue as a going concern. Based on the financial reporting frameworks mentioned, the Managing Board should prepare the financial statements using the going concern basis of accounting unless the Managing Board either intends to liquidate the Company or to cease operations, or has no realistic alternative but to do so. The Managing Board should disclose events and circumstances that may cast significant doubt on the Royal DSM's ability to continue as a going concern in the financial statements.

The Supervisory Board is responsible for overseeing Royal DSM's financial reporting process.

Our responsibilities for the audit of the financial statements

Our objective is to plan and perform the audit engagement in a manner that allows us to obtain sufficient and appropriate audit evidence for our opinion.

Our audit has been performed with a high, but not absolute, level of assurance, which means we may not detect all material errors and fraud during our audit.

Misstatements can arise from fraud or error and are considered material if, individually or in the aggregate, they could reasonably be expected to influence the economic decisions of users taken on the basis of these financial statements. The materiality affects the nature, timing and extent of our audit procedures and the evaluation of the effect of identified misstatements on our opinion.

A further description of our responsibilities for the audit of the financial statements is included in the appendix to this auditor's report. This description forms part of our auditor's report.

Amstelveen, 26 February 2020

KPMG Accountants N.V.

E.H.W. Weusten RA

Appendix: Description of our responsibilities for the audit of the financial statements

We have exercised professional judgement and have maintained professional scepticism throughout the audit, in accordance with Dutch Standards on Auditing, ethical requirements and independence requirements. Our audit included among others:

identifying and assessing the risks of material misstatement of the financial statements, whether due to fraud or error, designing and performing audit procedures responsive to those risks, and obtaining audit evidence that is sufficient and appropriate to provide a basis for our opinion. The risk of not detecting a material misstatement resulting from fraud is higher than the risk resulting from error, as fraud may involve collusion, forgery, intentional omissions, misrepresentations, or the override of internal control

obtaining an understanding of internal control relevant to the audit in order to design audit procedures that are appropriate in the circumstances, but not for the purpose of expressing an opinion on the effectiveness of Royal DSM's internal control

evaluating the appropriateness of accounting policies used and the reasonableness of accounting estimates and related disclosures made by the Managing Board

concluding on the appropriateness of the Managing Board's use of the going concern basis of accounting, and based on the audit evidence obtained, whether a material uncertainty exists related to events or conditions that may cast significant doubt on Royal DSM's ability to continue as a going concern. If we conclude that a material uncertainty exists, we are required to draw attention in our auditor's report to the related disclosures in the financial statements or, if such disclosures are inadequate, to modify our opinion. Our conclusions are based on the audit evidence obtained up to the date of our auditor's report. However, future events or conditions may cause a Company to cease to continue as a going concern

evaluating the overall presentation, structure and content of the financial statements, including the disclosures

evaluating whether the financial statements represent the underlying transactions and events in a manner that achieves fair presentation

We are solely responsible for the opinion and therefore responsible to obtain sufficient appropriate audit evidence regarding the financial information of the entities or business activities within the group to express an opinion on the financial statements. In this respect we are also responsible for directing, supervising and performing the group audit.

We communicate with the Supervisory Board regarding, among other matters, the planned scope and timing of the audit and significant audit findings, including any significant findings in internal control that we identify during our audit. In this respect we also submit an additional report to the Supervisory Board in accordance with Article 11 of the EU Regulation on specific requirements regarding statutory audits of public-interest entities. The information included in this additional report is consistent with our audit opinion in this auditor's report.

We provide the Supervisory Board with a statement that we have complied with relevant ethical requirements regarding independence, and to communicate with them all relationships and other matters that may reasonably be thought to bear on our independence, and where applicable, related safeguards.

From the matters communicated with the Supervisory Board, we determine the key audit matters: those matters that were of most significance in the audit of the financial statements. We describe these matters in our auditor's report unless law or regulation precludes public disclosure about the matter or when, in extremely rare circumstances, not communicating the matter is in the public interest.