Nutrition

x € million | 20191 | 2018 | |

Total | Total | Underlying business2 | |

Net sales: | |||

DSM Nutritional Products: | |||

| 2,892 | 3,134 | 2,749 |

| 2,046 | 2,019 | 1,989 |

| 425 | 382 | 382 |

| 93 | 112 | 112 |

5,456 | 5,647 | 5,232 | |

DSM Food Specialties | 572 | 490 | 490 |

Total | 6,028 | 6,137 | 5,722 |

Organic sales growth (in %) | 2 | 14 | 7 |

Adjusted EBITDA | 1,250 | 1,407 | 1,117 |

Adjusted operating profit | 881 | 1,111 | 821 |

Capital expenditure | 420 | 463 | 463 |

Capital employed at 31 December | 6,731 | 5,683 | 5,683 |

ROCE (in %) | 13.9 | 19.9 | 14.7 |

Adjusted EBITDA margin (in %) | 20.7 | 22.9 | 19.5 |

R&D expenditure | 218 | 206 | 206 |

Workforce at 31 December (headcount) | 14,599 | 13,628 | 13,628 |

- Including the impact of IFRS 16, see table Impact of IFRS 16.

- Excluding temporary vitamin effect, see table Temporary vitamin effect 2018.

- Other covers pharma and custom manufacturing & services activities.

Business

Our Nutrition cluster comprises DSM Nutritional Products and DSM Food Specialties. This cluster provides solutions for animal feed, food & beverages, pharmaceuticals, early life nutrition, nutrition improvement, dietary supplements and personal care. Our company is positioned in all steps of the respective value chains: the production of pure active ingredients, their incorporation into sophisticated forms and the provision of tailored premixes, forward solutions and branded consumer products. Our unique portfolio of products and services is global and highly diversified, serving customers and other stakeholders locally across various end-markets around the world.

Nutrition cluster performance

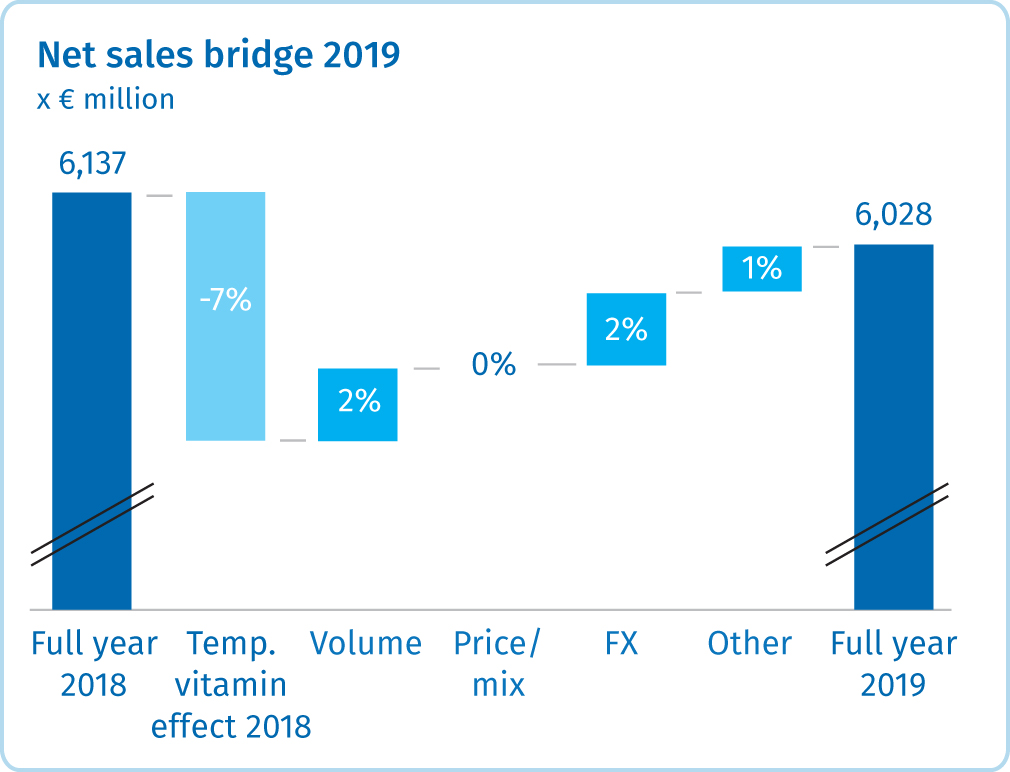

During the first nine months of 2018, the industry experienced an exceptional supply disruption. This event provided additional sales of €415 million and a corresponding Adjusted EBITDA of €290 million in the first nine months of 2018, as estimated and reported last year. 'Underlying business' is defined as the sales and Adjusted EBITDA, corrected for this temporary vitamin effect.

Nutrition reported total sales of €6,028 million in 2019, up from €5,722 million in the underlying business in 2018. Adjusted EBITDA was €1,250 million, up 12% from €1,117 million in the underlying business in 2018. The Adjusted EBITDA margin was 20.7%, up from 19.5% in the underlying business in 2018.

In 2019, Nutrition reported sales up 5% compared to 2018. Nutrition delivered 2% organic growth, which was volume-driven. Additionally, it recorded 1% from the consolidation of Andre Pectin and 2% from exchange rate effects driven by the US dollar. Nutrition delivered a good performance, with a solid performance in Animal Nutrition & Health, a softer one in Human Nutrition & Health, and a strong one in Personal Care & Aroma Ingredients and DSM Food Specialties.

Trends

The world is facing an increasing number of food-related health issues and challenges. According to the UN Food and Agriculture Organization (FAO), more than 820 million people go to bed hungry each night. The International Food Policy Research Institute (IFPRI) meanwhile estimates that approximately two billion people suffer from hidden hunger — meaning that their diet lacks sufficient micronutrients such as vitamins and dietary minerals. IFPRI additionally puts the number of adults and children who are obese or overweight at more than 2.3 billion.

With our nutritional solutions, we are well positioned to actively combat malnutrition in all its forms: undernutrition, micronutrient deficiency (hidden hunger), overweight, obesity and the double burden of malnutrition (the coexistence of micronutrient deficiency with overweight and obesity), as well as diet-related non-communicable diseases (NCDs). We have established numerous partnerships in this field, including those with the UN World Food Programme (WFP), UNICEF, Vitamin Angels and World Vision. We are also addressing malnutrition through the humanitarian organization Sight and Life and our dedicated Nutrition Improvement business segment — specialized in supplementation programs and the fortification of staple foods and therapeutic or emergency foods with essential vitamins and minerals in developing countries.

Mounting research over the past few decades continues to highlight the role nutrition plays during early life and its effect on life-long health. The first 1,000 days between the onset of a woman's pregnancy and her child's second birthday offer a unique window of opportunity for nutrition to shape healthier futures. Women hoping to become pregnant, pregnant women, infants and children must receive the necessary nutrients at appropriate levels to help set them on a path to a long, healthy life. Our Essentials For Early Life Solutions aim to ensure proper nutrition of parents-to-be, pregnant and nursing women, and young children, from preconception through the first 1,000 days of life.

Whereas earlier generations struggled primarily with the threat of communicable diseases such as tuberculosis, cholera and plague, non-communicable diseases are now the number one cause of death worldwide, accounting for 70% of all mortalities. These include cardiovascular disease, type 2 diabetes and cancer. Research increasingly identifies unhealthy and/or unbalanced diets as a major contributor to many NCDs. Intermediate indicators that can be related to an increased risk of NCDs are elevated levels of markers such as increased blood pressure, Body Mass Index (BMI) and high blood glucose. Balanced nutrition plays a role in keeping these indicators at healthy levels, hence helping to reduce the risks of NCDs. Besides solutions to reduce sugar and salt in processed foods, including EverSweetTM and Maxarome®, we also produce products such as OatWell®, a nutritional ingredient that harnesses the scientifically-proven health benefits of oat beta-glucan to reduce cholesterol levels.

The World Health Organization (WHO) predicts that antimicrobial resistance (AMR) will overtake NCDs by 2050 as the world's leading cause of death. WHO defines AMR as "the ability of a micro-organism (such as bacteria, viruses, and some parasites) to stop an antimicrobial (such as antibiotics, antivirals and antimalarials) from working against it". AMR is on the increase due to the over-prescription of antibiotics, the continued use of antibiotics in some livestock farming operations, and the release of antibiotics into the environment from pharmaceutical factories. At DSM, we address the topic of AMR and the responsible use of antibiotics in livestock production through our broad portfolio of nutritional products, such as our eubiotics for gastrointestinal functionality.

Environmental scientists warn that we are on the verge of breaching several planetary boundaries if we do not change our food system, risking people's livelihoods and the ability to produce the food for all. The planetary boundaries include the Earth's limits of greenhouse gas (GHG) emissions, biochemical flows, water quality and quantity, land use, and biodiversity. The agri-food sector is one of the major contributors to global GHG emissions, and almost a third of wild fisheries are overexploited.

We work with customers and other stakeholders to deliver more sustainable solutions that have less impact on the environment. With a growing population and growing middle class, we will see a rising demand for animal protein such as dairy, meat, eggs and fish, with a clear regional differentiation. Building on our strengths in animal nutrition science and sustainability, we have identified six business drivers to enable the sustainable growth of animal protein production for healthy diets within planetary boundaries. The business drivers comprise improving the lifetime performance of farm animals; making efficient use of natural resources; reducing emissions from livestock; helping tackle antimicrobial resistance; reducing our reliance on marine resources; and improving the quality of meat, milk, fish and eggs while reducing food loss and waste. For example, our enzymes help animals digest more efficiently and extract more nutritional value from the feed. They therefore still grow well even when consuming less. As a result, fewer natural resources, such as land and water, are needed for animal protein production.

In parallel to the growing demand for foods and beverages based on animal protein, there is a growing trend — especially in the Western world — in favor of natural and plant-based foods, such as meat and dairy alternatives. We have developed a Meat Alternatives Taste Toolbox based on natural yeast extracts, process flavors and hydrocolloids that deliver the savory, salty and umami flavor, and the fatty mouthfeel that consumers favor and expect from meat alternatives.

Sustainability & Innovation

Sustainability is one of the key drivers of our Nutrition cluster. Our nutrition businesses support many of the UN Sustainable Development Goals (SDGs), especially SDGs 2, 3, 12 and 13.

We are proud of our strategic partnership with the UN World Food Programme (WFP), which we extended in 2018 for another three years. We have partnered with WFP since 2007 to develop cost-effective, sustainable and nutritious food solutions for those in need. Today, the UN World Food Programme (WFP) reaches 35 million beneficiaries annually with food that is improved by the DSM-WFP partnership. Thanks to our expertise in nutrition and food fortification, WFP has improved its food basket and developed more nutritious food products for disadvantaged people around the world. These products include Super Cereal and Super Cereal Plus (complementary foods), ready-to-use supplementary foods, high-energy biscuits, micronutrient powders such as MixMe™, and fortified rice. We also provide funding for WFP's operations and motivate employees to engage in fundraising campaigns and awareness-raising initiatives for WFP's school meal programs. Finally, we combine our strengths to put local networks in place that ensure sustainable and increased access to more nutritious food as an essential part of healthy diets. Together, we are helping people survive and thrive.

In addition to our work on hunger, malnutrition, health and well-being, our innovations are increasingly focused on improved sustainability throughout the product lifecycle, and the value this can bring to customers and society at large.

For example, after a successful launch last year in the Americas, in 2019 we introduced Balancius®, a broiler feed ingredient that helps to facilitate digestion and the absorption of nutrients from the diet, in Europe and Asia-Pacific. This solution helps farmers to get more from their feed and to reduce GHG emissions.

We also made significant progress in Veramaris, our joint venture with Evonik to produce the omega-3 fatty acids EPA and DHA from natural marine algae as an alternative to fish oil. This innovation helps to reduce the pressure on wild fish stocks, helps the aquaculture industry to sustainably meet the rapidly growing global demand for seafood, and enables the production of healthier fish for the consumer.

In 2019, we also continued our work on Project Clean Cow, our feed additive that helps to reduce methane emissions from cows by at least 30%. Methane is a potent greenhouse gas that makes a significant contribution to climate change. Ruminants such as cows are responsible for approximately 27% of anthropogenic methane emissions globally. In 2019, we filed for EU market authorization under the product name Bovaer®. Registrations in other regions are to follow. The product will be available in Europe as soon as EU authorization is granted.

We accelerated our large innovation project for fermentative Stevia in 2019 by establishing a 50:50 partnership with Cargill called Avansya and starting the commercial-scale production of EverSweet™. EverSweet™ is a zero-calorie, great-tasting, cost-effective sweetener that can replace sugar in foods and beverages.

Governments around the world are focusing increasingly on the environmental footprint of their domestic industries. In recent years, China in particular has tightened the enforcement of its environmental regulations, also known as its 'Blue Skies' policy. This policy addresses air, soil and water pollution and sets significantly higher standards than before, including those standards applicable to China's vitamin manufacturers. Over time, the result is a more level playing field for non-Chinese competitors versus these manufacturers.

As part of our ongoing commitment to quality, safety, sustainability and production efficiencies, we made further upgrades to our vitamin C facility in Jiangshan (Jiangsu Province, China). Vitamin C from Jiangshan was already the lowest carbon footprint vitamin C in China thanks to this continuous investment program. Another example of our sustainability efforts is the opening of a new green co-generation plant in Sisseln (Switzerland) together with energy company ENGIE and Swiss energy provider EWZ, reducing CO2 emissions by 50,000 tons per year. For more information, see 'Renewable energy'.

Aerial view of the biomass plant at the DSM Sisseln site (Switzerland), April 2019.

Strategy

We have built a unique, highly integrated, global and broad nutritional and other specialty ingredient solutions business in food & beverages, animal feed and personal care, meeting differentiated local needs through our unparalleled network. We possess a diverse and significant premix footprint, with superior formulations and delivery systems, helping to drive sustainable nutritional and health solutions. This infrastructure is fueled by our complete portfolio of nutritional ingredients, which includes vitamins, nutritional lipids, carotenoids, dietary minerals, eubiotics, enzymes and yeasts, as well as texturants, flavors and cultures. This diversity and level of integration creates a resilient portfolio with limited exposure to single products or customers, while benefiting from the opportunities provided by global megatrends.

Focused on Nutrition & Health, we will continue to aim for above-market growth and an Adjusted EBITDA margin greater than 20% by 2021. We will complement organic growth with inorganic growth opportunities that broaden our portfolio and enhance our ability to provide customized solutions. At the same time, we will further build on the successful initiatives of Strategy 2018, increasingly placing the customer at the center of everything we do and achieving commercial excellence, while delivering large, sustainability-driven, innovation projects.

We made good progress on the inorganic growth front. In 2019, we increased our shareholding in Andre Pectin (China) from 29% to 75%. Andre Pectin is Asia's largest producer of apple and citrus pectin, hydrocolloids providing texture solutions for food, beverages and personal care, with premier access to the world's fastest-growing specialty food ingredients market. To further strengthen our position in personalized nutrition, we acquired AVA (USA), offering a personalized nutrition platform that provides nutrition and coaching recommendations across a wide range of health and wellness segments. We also acquired Royal CSK (Netherlands), combining complementary strengths to better serve DSM's largest food & beverage segment: the fast-growing and attractive dairy cultures markets.

We created the 75:25 partnership, Yimante (Hubei Province, China), with Nenter in 2019. Through this partnership, we strengthened our vitamin E position: it will provide us with cost-effective access to additional capacity, allowing us to continue to grow organically in vitamin E, which is an essential ingredient in our animal nutrition premix solutions.

In terms of our large, sustainability-driven, innovation projects, we also advanced well with Project Clean Cow (under the product name Bovaer®), Veramaris®, Avansya and Balancius®. Many other examples of new innovations and solutions can be found throughout this chapter.

Animal Nutrition & Health

Building on the results of our programs as part of Strategy 2018, we will continue to seek to deliver above-market sales growth through:

Marketing & sales excellence, especially building specialist capabilities to address wider species opportunities and pursue new health solutions

Customer-centricity and agility, to place the customer at the heart of everything we do, by improving the end-to-end experience for the customer

Further investing in our direct business-to-farmer offering (e.g., in China) and overall go-to-market capabilities

In addition, we pursue radical innovation for core sustainability topics, all of which seek to deliver long-term solutions for the industry with the potential to create significant value for our company and our customers. With examples such as algal-based omega-3 for fishfeed (Veramaris®) and methane-reducing feed additives for cows (Project Clean Cow), we position ourselves at the forefront to benefit from global megatrends.

Human Nutrition & Health

Building on the success of the first two parts of the LiftOff! Program as part of Strategy 2018, we will step up further during the implementation of Strategy 2021 with increased focus on customer-centricity and commercial excellence to drive above-market organic growth through:

Focusing on customer-centricity and agility, seeking to move closer to the customer by strengthening the value propositions of our products and services, improving end-to-end customer experiences, and enhanced innovation and application capabilities

Continuing to invest in business-to-consumer to ensure the growth of i-Health beyond the US, as well as further developing and building our personalized nutrition platform

In addition, we will continue to pursue inorganic growth opportunities in food & beverages as well as dietary supplements, to enhance and complement our already strong market positions.

An example of progress includes our continued investment in the breadth of our capabilities to support our customers' growth, with the establishment of Innovation & Application Centers in Isando (South Africa) and in Cairo (Egypt) in 2019. These are designed to stimulate and accelerate co-innovation with customers worldwide.

Partnerships

We have many partnerships that support and accelerate innovation in Nutrition. In Animal Nutrition & Health we have, for example, The Alliance of DSM and Novozymes, combining the world-leading competencies and technologies of the two companies to deliver feed enzyme innovation to the customers. The Alliance is the global market leader in feed enzymes. Another partnership is Veramaris, our 50:50 joint venture with Evonik with its breakthrough innovation — an algal oil — that, for the first time, enables the production of the omega-3 fatty acids EPA and DHA for aquaculture without using fish oil from wild-caught fish.

In Human Nutrition & Health, one example is Avansya, our partnership with Cargill to bring sustainably produced, great-tasting zero-calorie, cost-effective sweeteners to market faster. In personalized nutrition, we partner with companies such as Panaceutics and Wellmetrix. Combining their competences with our world-class nutrition science, products and solutions, we aim to be the partner of choice for dietary supplements as well as food & beverage brand owners that wish to offer personalized and healthy nutrition.

In early December, we also announced a brand new partnership in our Personal Care & Aroma Ingredients business: an exclusive, global strategic collaboration with METEX NØØVISTA, a subsidiary of biological chemistry company METabolic EXplorer, to deliver a 100% bio-sourced and sustainably produced, multifunctional ingredient for skincare products.

DSM Nutritional Products

DSM Nutritional Products consists of Animal Nutrition & Health, Human Nutrition & Health and Personal Care & Aroma Ingredients. In 2018, an exceptional supply disruption in the industry positively impacted our sales. We estimated a temporary vitamin effect of €415 million additional sales in 2018, mainly in Animal Nutrition & Health. The following sections compare results in the underlying business, so excluding this temporary vitamin effect. In 2019, DSM Nutritional Products reported sales of € 5,456 compared to € 5,232 million in the underlying business in 2018.

| “ | In 2019, we achieved good sales and earnings growth across our Nutrition cluster and took a big step toward market launch of our radical innovation projects in our Animal and Human Nutrition businesses.” |

Chris Goppelsroeder, DSM Executive Committee and President & CEO DSM Nutritional Products |

Animal Nutrition & Health

Highlights 2019

Solid performance despite the rapid spread of African swine fever

Completion of the global launch of Balancius®

Vitamin E partnership with Nenter completed

Opening of Veramaris commercial-scale production facility in Blair (Nebraska, USA)

Filed for EU authorization for methane-reducing Project Clean Cow feed additive

Animal Nutrition & Health reported sales of €2,892 million in 2019 versus €2,749 million in the underlying business in 2018. In 2019, Animal Nutrition & Health reported 4% organic growth, against a strong 8% last year and despite the negative effect of African swine fever (ASF). This demonstrates the resilience of the integrated and diversified business model and our ability to address a wide range of species as well as a diversified geographical presence.

Sales were strong for all species and in all regions, except for sales to the swine business in China and South-East Asia, which were impacted by ASF. This region accounts for more than half of global pork production, with culling measures introduced in response to ASF affecting 35–50% of pork production in the area. The rapid spread of this disease disrupted the global equilibrium of the animal protein sector in the short term. As a result, in the second half of 2019, we were unable to fully offset the impact of the decline in pork production in the region with increases in production from other regions and species. Overall, volumes and prices were both up by 2%. The price increase was due to positive sales mix effects, as well as price increases earlier in the year for some ingredients to compensate for higher costs.

Animal Nutrition & Health serves the global feed industry with innovative and sustainable nutritional solutions. A pioneer since the earliest days of feed additives, we draw on the latest science to provide a unique portfolio that runs from vitamins through carotenoids to cutting-edge eubiotics and feed enzymes.

Population growth and rising incomes are driving global demand for animal protein. We focus our passion and expertise on the following six business drivers to support the livestock value chain and address the challenges facing our planet:

Improving the lifetime performance of farm animals

Making efficient use of natural resources

Reducing emissions from livestock

Helping tackle antimicrobial resistance

Reducing our reliance on marine resources

Improving the quality of meat, milk, fish and eggs while reducing food loss and waste

We strongly believe in sustainable food systems, and that the livestock industry can transform itself from within to deliver the solutions to the challenges facing society and the animal protein industry. We want to play a key role in this transformation, and we work at species and country level to provide tangible and actionable solutions that will help build a sustainable future for us all.

The global pork industry was impacted significantly by ASF in 2019, with China and Asia feeling its adverse effects on herd size and production. The decline in pork production in China was partly offset by an increase in imports of pork to China, as well as other sources of protein in the form of poultry and fish. Our swine business was well placed to adapt to these market conditions and address changes in the protein production value chain with our well-balanced species and solutions approach. Other regions — EMEA, Latin America and North America — are well positioned to help meet the increased demand for exported pork.

Our Crina® range of essential oils enjoyed strong demand in key markets during 2019. Crina® Poultry Plus is the market-leading solution, combining a unique and complementary blend of essential oil compounds with the most efficient organic acid (benzoic acid) to modulate the microbiota and stimulate the secretion of digestive enzymes. Furthermore, Crina® Digest, the latest innovation in our portfolio, was launched in Europe at the end of 2018. Its global expansion is currently taking place for poultry applications.

In 2019, we completed the global launch program for our latest breakthrough innovation, Balancius®, introducing it in the EU and Asia-Pacific. Balancius® is the first and only feed ingredient capable of breaking down peptidoglycans (PGNs) in bacterial cell debris, thus releasing otherwise inaccessible nutrients and unlocking a hidden potential in gastrointestinal functionality. Scientific data demonstrates that the addition of Balancius® to the diet of broiler chickens significantly improves the ability to digest and absorb nutrients. It consistently improves the feed conversion ratio (FCR) by 3%, thus making a measurable contribution to sustainable poultry production. Balancius® additionally improves breast meat yield and contributes to better animal welfare by helping to keep litter dryer.

By comparison with 2018, the global broiler meat market experienced a more balanced supply in most regions during 2019. Our broiler business delivered robust performance, and we are stepping up our efforts to offer broiler meat producers more tools to meet consumer demands for a high-quality, affordable meat product.

Our business with layers showed profitable volume growth in 2019 thanks to the strong performance of China, EMEA and Asia-Pacific. This was attributable to the impact of ASF and the growing demand for eggs. We also entered into on a collaboration with the International Egg Commission, supporting the Commission's work on sustainability in egg production.

In the ruminant sector, ongoing growth opportunities exist in the US, Eastern Europe, Asia, Argentina, Brazil and now also China. The year 2019 was a challenging one for this sector, but we were able to maintain growth in our core portfolio, and we succeeded in further growing certain key products for dairy cows. Our initiatives to become a leader in sustainable dairy farming made us a preferred partner in the global alliance Farming for Generations, which is led by the global food industry leader Danone.

Our aquaculture business performed strongly in 2019. Improving survival rates, reducing environmental impact and optimizing raw materials are key enablers for both cold-water and warm-water fish and shrimp species.

In the pet food industry, the increasing trend to treat pets as part of the family has driven up product standards through the use of higher-value functional ingredients. This has translated into higher pricing. Marketing and product labeling trends in the pet food market are mirroring those observed in human nutrition and consumer goods, and are driving growth in the US, Europe, and Japan especially.

In terms of our regional presence, our business enjoyed strong growth in Asia–Pacific during 2019, led by South East Asia and the Indian subcontinent.

Challenged by the unprecedented outbreak of ASF in 2019 as well as by its knock-on effect on all other species, our business in China successfully developed and implemented a strategy of promoting growth across all six species served by our portfolio. This resulted in robust volume growth in poultry in China that significantly outperformed the market. A holistic action plan was created and trialed to ensure that we are prepared for the forthcoming regulations on ASF. Significant resources were allocated, and global and regional teams are collaborating closely to ensure effective implementation.

We made significant progress in Latin America during 2019, notably at our new premix plant in Peru, increasing and improving production capacity for the country as a whole. Our enhanced species expertise stimulated expansion in strategic markets, delivering growth in the poultry sector in the Southern Cone and Central America; in aquaculture in Chile and Ecuador; in swine in Brazil; and in ruminants in Mexico and Paraguay. EMEA and North America both remained important sources of revenue.

We took a game-changing step in sustainable aquaculture in 2019, commencing commercial-scale production of algal-based omega-3 at our Veramaris facility in Blair (Nebraska, USA) — a USD 200 million facility. Our proprietary technology delivers a breakthrough in the cultivation of marine algae naturally rich in EPA and DHA omega-3, facilitating production on an unprecedented scale. Sales of the first salmon fed with Veramaris® algal oil also commenced in retail outlets in Germany (Kaufland) and France (Supermarché Match).

Regarding methane reduction, we filed for EU authorization in 2019 and took the next step toward implementing our Project Clean Cow (under the product name Bovaer®) methane inhibitor in the Netherlands. It is the most extensively studied and scientifically proven solution to the challenge of burped methane from ruminants to date. Over the past ten years, 35 on-farm beef and dairy trials have been conducted across the globe and in the context of various feeding systems. These show that a reduction in enteric methane of approximately 30% can be consistently achieved. Some trials achieved a reduction of as much as 80%.

Human Nutrition & Health

Highlights 2019

Good growth in Medical Nutrition and Dietary Supplements

Softer macroeconomic conditions increasingly weighed on Food & Beverage

Acquisition of AVA, a personalized nutrition platform

Growing consumer preference for plant-based nutritional products, such as life's™OMEGA

Vitamin C facility in Jiangshan has the lowest carbon footprint in China

Human Nutrition & Health reported sales of €2,046 million in 2019 versus €1,989 million in the underlying business in 2018. Our Human Nutrition & Health business delivered 3% sales growth and -1% organic growth, against a tough comparison of 7% organic growth in 2018, in increasingly challenging end-markets. Volumes were up 2% and prices declined by 3%. After a strong start to the year, softer macroeconomic conditions increasingly weighed on the Food & Beverage segment, especially in North America. The softness was most pronounced in the case of larger customers. Smaller customers were less impacted.

Medical Nutrition and Dietary Supplements (driven by the double-digit growth in the i-Health segment, our business-to-consumer business) performed well over the year. Early Life Nutrition showed a strong performance in the first three quarters of the year, with a softer fourth quarter. Lower prices for vitamin C and negative mix effects resulted in 3% lower prices.

Human Nutrition & Health provides solutions for the food & beverage, dietary supplement, early life nutrition, medical nutrition, nutrition improvement and active pharmaceutical ingredient (API) markets. We serve these industries with a portfolio of products (vitamins, nutritional lipids, carotenoids, nutraceuticals, digestive enzymes, probiotics and prebiotics, as well as APIs), a suite of customized solutions (premix, coloration, shelf-life and market-ready solutions), and a range of expert services. i-Health — a global consumer health and wellness company, and a subsidiary of DSM — develops, markets and distributes branded products that support health and wellness. Core categories include microbiome health, healthy aging, and urinary health.

Our business continues to get closer to the consumer in the value chain, focusing more intensely on the business-to-consumer and personalized nutrition sectors. A growing proportion of our revenue — more than 40% — now comes from custom nutrient premixes, market-ready solutions and direct-to-consumer products that address diverse health or lifestyle benefits.

Culturelle® was the main driver of the i-Health business in 2019. The world's number one probiotic brand enjoyed double-digit growth despite the relatively sluggish progress of the category in its biggest market, the US. This was thanks to innovative line extensions as well as progress in new sales channels.

During 2019, we continued to invest in the breadth of our capabilities to support our customers' growth. We established Innovation & Application Centers in Isando (South Africa) and in Cairo (Egypt) in 2019. These hubs, as well as the newly-opened center in Kaiseraugst (Switzerland), join our global network of Innovation & Application Centers designed to stimulate and accelerate co-innovation with customers worldwide.

Our strong progress in the pharmaceutical industry in the past few years can be attributed to our leading and growing position in regulatory capabilities, which allows us to help register customers' products containing our APIs in target markets. In 2019, we continued to expand these capabilities, including the Drug Master File (DMF) numbers in China for Vitamin B1 and B6 APIs and the renewal of 25 Indian API registrations, thereby enabling our biopharmaceutical partners to use these ingredients in the development of proprietary drug products.

Personalized Nutrition continues to play a key role in our human nutrition strategy. The acquisition of AVA in the US, a state-of-the-art digital health platform that provides sophisticated data analysis and recommendations, complements previous investments in key capabilities. These include personalized nutrition delivery platforms, such as Panaceutics, Mixfit and Tespo, as well as partnerships related to selected measurement and tracking technologies, such as Wellmetrix. Combining this with our world-class nutrition science, products and solutions, we aim to be the partner of choice for dietary supplements as well as food & beverage brand owners that wish to offer personalized nutrition and gain unique consumer insights.

We work with our customers to develop sustainable products with a high nutritional value that help keep the world's growing population healthy and have a limited impact on the environment. For example, our life's™OMEGA is an algae-based source of omega-3 EPA and DHA and nearly twice as potent as fish oil. It provides important heart health benefits throughout life. This product was the first vegetarian ingredient to make both EPA and DHA available in a capsule, providing a sustainable alternative to traditional fish oil. This business has grown at double-digit rates since 2018, reflecting consumers' increasing preference for plant-based solutions.

Another example of our sustainable solutions is the upgrade of our plant in Jiangshan (Jiangsu Province, China). This facility produces vitamin C with the lowest carbon footprint in China and generates GHG emissions 32% lower than alternative sources in the country.

Personal Care & Aroma Ingredients

Highlights 2019

Above-market growth in both Personal Care and Aroma Ingredients

First results of full operationalization of new business unit strategy

Launch of new innovations in skin and sun care

DSM Personal Care & Aroma Ingredients reported total sales of €425 million in 2019 compared to €382 million in 2018. Full year 2019 sales were up 11%, with a very strong 9% organic growth and a 2% contribution from foreign exchange rate effects. All Personal Care product lines, including sun, skin and hair care delivered good above-market growth, with Aroma Ingredients also performing well in 2019. Successful commercialization of the innovation pipeline further contributed to a very good year for the business.

Personal Care & Aroma Ingredients offers solutions for customers in the personal care, home care and fine fragrance markets. Our extensive portfolio includes aroma ingredients, vitamins and natural bio-actives, as well as UV filters, peptides and polymers. Our solutions support the health and beauty needs of an aging population with various skin and hair types around the world, and address increasing concerns around global public health issues such as air pollution and skin cancer.

Our new business unit strategy started to show results in 2019. Our Personal Care portfolio enjoyed above-market growth across regions and segments, with exceptional growth in Asia-Pacific as well as in the photoprotection and skin bio-actives segments. Our Aroma Ingredients portfolio, meanwhile, showed ongoing strong growth, with some shifts toward higher-value products on the part of certain global key customers, in full alignment with our new strategy.

With the current strong trend for natural Personal Care products, our biotechnology capabilities are encountering considerable interest among major flavor & fragrance players. Bergalin — an allergen-free aroma solution for skin-sensitive applications — was launched, and received positive market feedback.

We continued building and leveraging our innovation competences in photoprotection, peptides and polymers in 2019. At the same time, we kept up our expansion into new fields such as the skin microbiome and technical and performance ingredients.

Examples include the launch of TILAMAR® Boost 150, a unique hyper-branched polymer that offers high volume and care properties, and PARSOL® ZX, a mineral UV filter that builds on the growing consumer demand for natural sunscreens. In addition, DSM Venturing made an equity investment in Belgium-based skin microbiome company S-Biomedic in 2019. This investment underlines our commitment in the skin microbiome, an area with significant growth potential. In December we also announced a brand new partnership in our Personal Care business: an exclusive, global strategic collaboration with METEX NØØVISTA, a subsidiary of biological chemistry company METabolic EXplorer, to deliver a 100% bio-sourced and sustainably produced, multifunctional ingredient for skincare products.

In 2019, DSM Personal Care & Aroma Ingredients rolled out a SUSTAINABILITY IMP'ACT CARDS program that provides transparency regarding the environmental impact, social impact, traceability and identity of our ingredients.

DSM Food Specialties

Highlights 2019

Good sales growth in hydrocolloids, enzymes, cultures and yeast extracts

Acquisition of Royal CSK, combining complementary strengths to better serve the global dairy industry

Leading position in taste solutions for plant-based meat alternatives

Avansya, our partnership with Cargill, opened a commercial-scale fermentation facility in the US for sustainably produced non-artificial, zero-calorie, great-tasting stevia sweeteners

Increase of shareholding in Andre Pectin from 29% to 75%

DSM Food Specialties reported total sales of €572 million in 2019 compared to €490 million in 2018. In 2019, sales were 17% higher versus the prior year, 4% resulting from organic growth, 12% from the consolidation of Andre Pectin following the increase in our shareholding from 29% to 75% and 1% from exchange rates effects. All major business lines performed well over the year, with especially a good sales growth in cultures and food enzymes in dairy and baking. Andre Pectin performed well.

DSM Food Specialties is a leading global supplier of specialty food enzymes, cultures, probiotics, bio-preservation, hydrocolloids, sugar reduction, and savory taste solutions to customers in the food & beverage industry in dairy, baking, beverages, and savory. Our ingredients and solutions are widely used to create a broad range of food products, from grocery favorites such as yogurt, cheese and soups to specialized products including gluten-free bread and beer, meat alternatives, lactose-free milk, and sugar-reduced beverages.

Demand for our products is driven by five main market trends: sugar reduction; enhanced taste experience; improved health and wellness; more efficient and sustainable production; and reduction of food loss and waste. With 150 years of experience in biotechnology and fermentation, we aim to enable better food for everyone, helping to make existing diets healthier and more sustainable, and giving increasing numbers of people around the world access to affordable, quality food.

In dairy, our single largest segment in food & beverages, we acquired specialty dairy solutions provider Royal CSK (Netherlands). The highly complementary combination of our dairy business and CSK's business greatly strengthens our ability to serve the needs of dairy industries worldwide, and makes us well-placed to address the fast-growing and attractive dairy cultures markets.

In baking, shelf-life and freshness are a key trend. Our enzymes play a key role in keeping bread fresh for longer as it moves from bakery to store and finally into the consumer's hands. We introduced a well-received suite of new freshness solutions during 2019 that deliver improved softness and resilience along with optimum sliceability in products including bread, wraps and tortillas, helping to combat waste in the segment.

In beverages, production efficiency improvements and a reduced environmental footprint remain major drivers for many of the world's leading brewers. Demand remained strong for our enzymatic solutions, including Brewers Clarex® and Brewers Compass®, which enable significant energy savings.

Demand for plant-based meat alternatives is growing fast. Recreating meat flavor in plant-based meat replacers, such as plant-based patties, is notoriously challenging. We have developed a Meat Alternatives Taste Toolbox based on natural yeast extracts and process flavors that deliver the savory, salty and umami flavor, as well as the fatty mouthfeel that consumers favor. This helped us take a leading position in this space in 2019.

Shelf-life extension is a trend that touches all food & beverage segments. Our portfolio of bio-preservation and anti-oxidant solutions offers brand owners clean-label alternatives to artificial preservatives. In dairy, we provide for example enzymes, protective cultures, and anti-oxidant and anti-fungal solutions to protect foods against physical, chemical and microbial spoilage. This is a growth area with significant upward potential for DSM.

We accelerated our innovation project for fermentative Stevia. We established the Avansya partnership with Cargill announced at the end of 2018. We opened the first commercial-scale fermentation facility for stevia sweeteners in the US and saw the launch of the first consumer products in the US and Mexico. For more information, see 'Case studies Nutrition'.

Another growth platform in specialty food ingredients is hydrocolloids — thickeners and stabilizers that dissolve, disperse or swell in water to provide a broad range of important functionalities and physical attributes including gelling, texture, mouthfeel, viscosity and suspension. Demand for hydrocolloids, especially our natural hydrocolloids, is driven by three underlying consumer trends:

The quest for convenient foods and beverages

Increasing demand for dairy- and plant-based protein drinks

The trend toward clean labeling

Our hydrocolloids are primarily delivered in the form of pectin and bio-gums. Both are used as gelling and stabilizing agents in a variety of foods and beverages. Our natural hydrocolloids are enjoying strong sales growth.

Responding to rapidly growing global demand for pectin, we increased our shareholding in Andre Pectin from 29% to 75% in 2019. Andre Pectin is a leading specialty food ingredient producer. Our share increase in Andre Pectin, together with our earlier announced pectin plant expansion, further demonstrates our full commitment to the fast-growing pectin industry and enhances our position as one of the leading global hydrocolloids players.