Information on the DSM share

Shares and listings

Ordinary shares in Koninklijke DSM N.V. are listed on the Euronext stock exchange in Amsterdam (Netherlands) (Stock code 00982, ISIN code NL0000009827). Options on ordinary DSM shares are traded on the European Option Exchange in Amsterdam (Euronext.liffe). In the US, a sponsored unlisted American Depositary Receipts (ADR) program is offered by Deutsche Bank Trust Co. Americas (DR ISIN US7802491081), with four ADRs representing the value of one ordinary DSM share.

Besides the ordinary shares, 44.04 million cumulative preference shares A (cumprefs A) are in issue, which are not listed on the stock exchange; these have been placed with institutional investors. The cumprefs A have the same voting rights as ordinary shares, as their nominal value of €1.50 per share is equal to the nominal value of the ordinary shares.

The dividend percentage of the cumprefs A is based upon the dividend yield of the ordinary shares (dividend as a percentage of the average share price). This percentage may be increased or decreased by a markup or discount of no more than one hundred (100) basis points, to be determined by the Managing Board in consultation with the Supervisory Board. The basis of computation of the dividend on the Preference Shares is €5.2942.

Transfer of the cumprefs A requires the approval of the Managing Board, unless the shareholder is obliged by law to transfer his shares to a previous shareholder.

The average number of ordinary shares outstanding in 2019 was 175,730,949. All shares in issue are fully paid. On 31 December 2019, the company had 172,448,755 ordinary shares outstanding.

Issue of shares

The issue of shares takes place by a decision of the Managing Board. The decision is subject to the approval of the Supervisory Board. The scope of this power of the Managing Board shall be determined by a resolution of the General Meeting of Shareholders and shall relate to at most all unissued shares of the authorized capital, as applicable now or at any time in the future. In the Annual General Meeting of Shareholders of 8 May 2019 this power was extended up to and including 8 November 2020, on the understanding that this authorization of the Managing Board is limited to a number of ordinary shares with a nominal value amounting to 10% of the issued capital at the time of issue, and to an additional 10% of the issued capital at the time of issue if the issue takes place within the context of a merger or acquisition within the scope of DSM's strategy as published on the company website. The issue price will be determined by the Managing Board and shall as much as possible be calculated on the basis of the trading prices of ordinary shares on the Euronext Amsterdam Stock Exchange.

Distribution of shares

Under the Dutch Financial Markets Supervision Act, shareholdings of 3% or more in any Dutch company must be disclosed to the Netherlands Authority for the Financial Markets (AFM). According to the register kept by the AFM, the following shareholders had disclosed that they have a direct or indirect (potential) interest between 3% and 10% in DSM's total share capital on 31 December 2019:

ASR Nederland N.V.

BlackRock, Inc.

Capital Research and Management Company, Capital Group International Inc. and EuroPacific Growth Fund

NN Group N.V.

Rabo Participaties B.V.

Repurchase of own shares

The company may acquire paid-up own shares by virtue of a decision of the Managing Board, provided that the par value of the acquired shares in its capital amounts to no more than one tenth of the issued capital. Such a decision is subject to the approval of the Supervisory Board. In the Annual General Meeting of Shareholders of 8 May 2019, the Managing Board was authorized to acquire own shares for a period of 18 months from said date (i.e., up to and including 8 November 2020), up to a maximum of 10% of the issued capital, provided that the company will hold no more shares in stock than at maximum 10% of the issued capital.

In 2019, DSM announced a share buyback program with an aggregate market value of €1 billion starting in the second quarter of 2019, with the intention to reduce its issued capital. This program was in addition to the usual repurchase programs which DSM executes from time to time to cover commitments under share-based compensation plans and the stock dividend. In 2019, DSM repurchased 5,362,936 of its own shares for a consideration of €600 million.

In 2019, DSM repurchased 2,600,000 shares for a total consideration of €268 million for the purpose of covering the company's commitments under existing management and employee share plans and stock dividend. This program included share-based compensation plans (800,000 shares) and stock dividend as part of the final dividend 2019 (1,800,000 shares).

In total, DSM repurchased 7,962,936 of its own shares for a combined consideration of €869 million.

Development of the number of ordinary DSM shares

2019 | 2018 | |||

Issued | Repurchased | Outstanding | Outstanding | |

Balance at 1 January | 181,425,000 | 5,774,425 | 175,650,575 | 174,643,475 |

|---|---|---|---|---|

Changes: | ||||

Reissue of shares in connection with share-based payment plans | - | (3,395,405) | 3,395,405 | 2,090,107 |

Repurchase of shares | - | 7,962,936 | (7,962,936) | (2,700,000) |

Dividend in the form of ordinary shares | - | (1,365,711) | 1,365,711 | 1,616,993 |

Balance at 31 December | 181,425,000 | 8,976,245 | 172,448,755 | 175,650,575 |

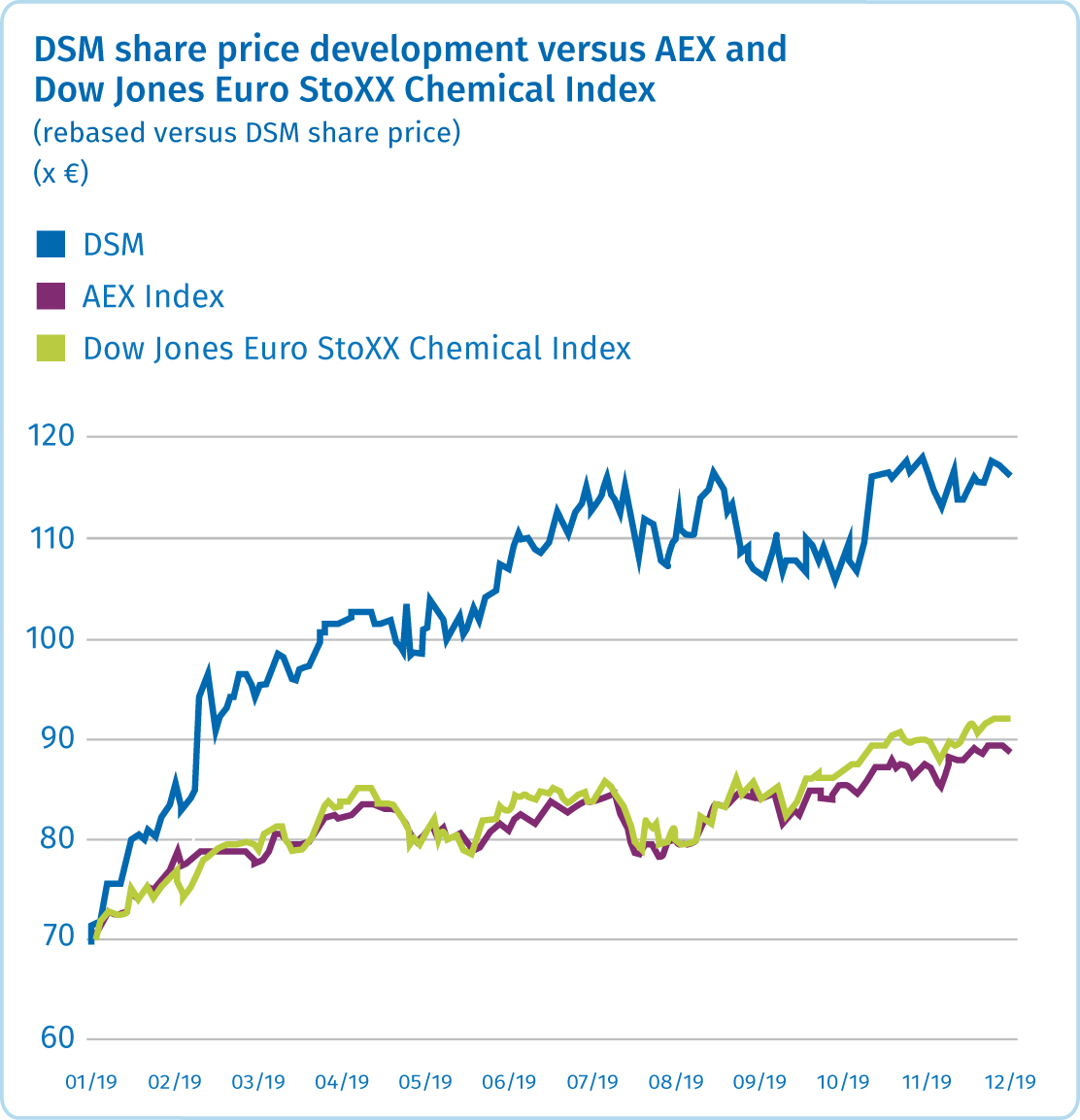

DSM share prices on Euronext Amsterdam (€ per ordinary share): | ||||

Highest closing price | 117.90 | 92.98 | ||

Lowest closing price | 69.54 | 68.98 | ||

At 31 December | 116.10 | 71.44 | ||

Market capitalization at 31 December (€ million)1 | 21,063 | 12,961 | ||

- Source: Bloomberg.

Geographical spread of DSM shares outstanding

in % (excl. cumprefs A) | 2019 | 2018 |

North America | 39 | 38 |

United Kingdom | 17 | 16 |

Netherlands | 12 | 14 |

France | 11 | 11 |

Germany | 4 | 5 |

Switzerland | 4 | 4 |

Asia–Pacific | 4 | 5 |

Other countries | 9 | 7 |

Trading volume ordinary DSM shares 2019

x million shares as reported by Euronext Amsterdam

Article 10 of Directive 2004/25

With regard to the information referred to in the Resolution of article 10 of the EC Directive pertaining to a takeover bid which is required to be provided according to Dutch law, the following can be reported:

Information on major shareholdings can be found above (Distribution of shares)

There are no special statutory rights attached to the shares of the company

There are no restrictions on the voting rights of the company's shares. When convening a General Meeting of Shareholders, the Managing Board is entitled to determine a registration date in accordance with the relevant provisions of the Dutch Civil Code

The applicable provisions regarding the appointment and dismissal of members of the Managing Board and the Supervisory Board and amendments to the Articles of Association can be found in the chapter 'Corporate governance and risk management'

The powers of the Managing Board regarding the issue and repurchase of shares in the company can be found in the sections Issue of shares and Repurchase of own shares above

Other information can be found in the 'Notes to the consolidated financial statements' (16 'Equity', 19 'Borrowings', 27 'Share-based compensation')

Dividend on ordinary shares

DSM's dividend policy is to provide a stable and preferably rising dividend. DSM proposes to increase the dividend by about 4.3% to €2.40 per ordinary share for 2019, reflecting our confidence in expected future earnings and cash generation.

This will be proposed to the Annual General Meeting of Shareholders to be held on 8 May 2020. An interim dividend of €0.77 per ordinary share having been paid in August 2019, the final dividend would then amount to €1.63 per ordinary share.

The dividend will be payable in cash or in the form of ordinary shares at the option of the shareholder, with a maximum of 40% of the dividend amount available for stock dividend. If more than 40% of the total dividend is requested by the shareholders to be paid out in shares, those shareholders who have chosen to receive their dividend in shares will receive their stock dividend on a pro-rata basis, the remainder being paid out in cash. Dividend in cash will be paid after deduction of 15% Dutch dividend withholding tax. The ex-dividend date is 12 May 2020.

Dividend per ordinary DSM share in €

2019 dividend subject to approval by Annual General Meeting of Shareholders

Dividend on Cumulative Preference Shares A

DSM will pay a dividend of €0.17 per share for 2019, identical to the dividend on the Cumulative Preference Shares A (cumprefs A) for 2018.

The dividend on the cumprefs A is based on the dividend yield of the ordinary shares, being about 2.31% for 2019. The Managing Board in consultation with the Supervisory Board decided to use their discretionary power to increase this percentage of about 95 bps to 3.26%. Where the proposed dividend for the ordinary shareholders will increase by about 4.3% versus 2018, the Managing Board felt it appropriate to keep the dividend on the cumprefs A equal to 2018.

Bearer shares

On 27 April 2006, all bearer shares ('aandelen aan toonder') in DSM's issued share capital were converted into registered shares ('aandelen op naam') (pursuant to an amendment of the Articles of Association made at the time). In order to exercise the rights vested in the shares, holders of former bearer shares were required to hand in their bearer share certificates ('aandeelbewijzen') to DSM.

Pursuant to an amendment of Section 2:82 of the Dutch Civil Code (DCC) in 2019, DSM shareholders who still have not handed in their bearer share certificates will lose any entitlement to exchange their bearer share certificates for a replacement share as per 2 January 2026.

In accordance with Section 2:391(2) DCC, DSM hereby gives notice of the following:

(i) A shareholder may not exercise the rights vested in a share until after he/she has handed in his/her bearer share certificates to DSM.

(ii) A bearer share certificate which has not been handed in to DSM on or before 31 December 2020 shall become void and the share represented by the bearer share certificate shall be acquired by DSM for no consideration, irrespective of whether DSM's Articles of Association allow the acquisition of its own shares. Section 2:98a (3) DCC does not apply to this acquisition. DSM shall be registered as the shareholder thereof in DSM's shareholders register. DSM shall hold the shares until the end of the period mentioned in (iii) below.

(iii) A shareholder who hands in a bearer share certificate to DSM no later than five years after the acquisition mentioned in (ii) above, therefore no later than 1 January 2026, is entitled to receive from DSM a replacement registered share provided that this share is registered in DSM’s shareholders register in the name of a central securities depository, and DSM will instruct the shareholder’s bank to credit the share in a securities account in the name of holder of the bearer share certificate.

The procedure described above follows from Section 2:82(3) up to and including (9) DCC, whose provisions apply.